Table of Contents

The Best Coinrule Strategies

Much better than creating a trading strategy from scratch is to find a list of ready-to-use templates for your trades, isn’t it? We know how much money (AND TIME) we can lose with the trial and error approach.

So, in order to solve this quickly and smoothly, we gathered the best and most used Coinrule Templates below.

If you’re really into Crypto Bots, please have a look at these two other articles:

Cryptohopper Best Strategies

Bitsgap Best Strategies

Buy The Dip Multi-Level | Coinrule Best Strategies

A beginner-friendly rule that assists to capture dips on coins when it’s most practical to trade them.

Buying-the-dips is an easy yet effective automated trading system that can supply amazing returns when the marketplace is trending up. Not all rate dips are excellent buy-opportunities, though. The rule filters the most effective ones.

Often a price decrease indicates that the fad is damaging, and also the price may stay low for a longer time. That’s not what you may desire from a coin you simply got!

How does it work?

The strategy gets when the coin has a price decline while trading in a larger uptrend.

All you require to do is pick the wallet you want to utilize for buying– for example, fiat money, like USD or EUR. Additionally, a steady coin, like USDT, or you can additionally trade using BTC.

Pro-tip: the method functions better when the market’s state of mind is positive as well as rates are up for a few days.

A multi-level evaluation

The technique determines the drop from two different time point of views to enhance the time to purchase.

- The coin is up 3% in 6 hours

- The price of that coin dips 1% in 1 hour.

That suggests that the rate decline didn’t remove much of the current uptrend of the coin, and also there can still be potential for more upside.

Protect your trades

The bot protects all your trades to decrease the danger of losses as well as take advantage of the profit if the price increases.

The system offers the coin when one of the two complying with scenarios take place:

- the price reduces 3% from the buy price, as a stop loss

- the price raises 4% from the buy price, as a take profit.

Backtest the technique on Tradingview

You can backtest this strategy using this trading script released on Tradingview. You can check the results on historic information, selecting the coin of your choice, as well as adjusting the parameters to fit also better your demands.

This is a guide to learn just how to backtest techniques on Tradingview.

Ride The Trend | Coinrule Best Strategies

Catch at any moment the possibility of purchasing the coins with one of the most powerful uptrends on the marketplace.

The Relative-Strength Index (RSI) is a technical indicator that determines the size of a coin’s price actions. High values show that the price is rising swiftly. Reduced worths, on the contrary, signal that the price is dropping.

Cryptocurrencies can experience abrupt and sharp uptrends, as well as the RSI is a beneficial device to discover them. The Coinrule template identifies the coins on a solid trend as their price could raise much more.

How does it work?

Theoretically, an RSI over 70 ways that the coin’s price currently raised considerably and, hence, maybe a great time for marketing. On the various other hands, the RSI of cryptocurrencies might stay at high worths for an extended period.

In the instance listed below, the RSI of Waves remains over 60, and also commonly over 70, for virtually one month. Getting and offering en route up would have supplied superb possibilities.

Pro-tip: you can run this coinrule template in every market problem. In times of market downtrend, seldom the RSI will certainly go too high worths so that the strategy will certainly wait on easier market problems before opening up brand-new trades.

Avoid pump-and-dumps

The RSI should be over 70 in a time frame of 4-hours (i.e., considering the 4-hr graph) to open the setting. That implies that the technique acquires coins that get on solid uptrends, avoiding temporary pump-and-dumps, where the threat of getting the top is really high.

The finest time structure for this technique is the 4-hr. Various other period is not suggested.

Close your trades

The strategy markets the coins if the price increases 6% from the entrance price. Alternatively, it shuts the position if the RSI drops listed below 55, indicating a feasible weakening of the fad.

The coinrule template can just purchase one coin at once with the default setup. If you want to open up numerous trades at the same time, you can make use of the Any Time Operator.

Backtest the approach on Tradingview

You can backtest this approach using this trading script published on Tradingview. You can check the results on historical data, selecting the coin of your choice, and also readjusting the parameters to fit also better your needs.

Maximized Moving Average Crossing | Coinrule Best Strategies

The approach integrates 2 of one of the most usual indicators to produce an effective long-lasting method for acquiring coins with upside possibilities.

Is it feasible to enhance among the most typical and successful trading methods? This coinrule template aims to catch the very best trend opportunities dynamically on the market.

The strategy utilizes Moving Averages and the RSI to maximize the returns.

How does it work?

Among the most common trading methods for beginners includes buying when 2 Moving Averages crosses. That is a Trend-Following technique. As the name would certainly suggest, to be successful, it calls for the asset to be on-trend.

Adding the RSI to the problem sees to it that there are more possibilities of closing the selling profit due to the fact that greater RSI values show that the coin has volatility and, therefore, upside possibilities.

Pro-tip: this is a long-lasting strategy that does on all coins. By default, the rule opens one trade at a time, yet you can increase the trade regularity using the Any Time Operator.

Find the best time for buying

When the MA9 goes across above the MA50, that suggests that the coin is potentially going into an uptrend. On the other hand, this can additionally happen in times of reduced volatility when the Moving Averages are extremely near to one another. That is the main restriction of utilizing this sign.

By adding the RSI to the buy problem, the coinrule template can trade when the chances of shutting the selling profit are higher.

The best time frame for this arrangement is the 1-hour, however, it can also function well on the 4-hour.

Close your trades

The technique shuts the trade when the contrary crossing occurs, suggesting that the pattern is compromising, and also it’s proper to leave the position.

Because there is no set level to shut the position, the method can dynamically comply with the fad to make the best use of profit.

Backtest the method on Tradingview

You can backtest this approach utilizing this trading script released on Tradingview. You can check the outcomes on historical information, choosing the coin of your option, and also changing the parameters to fit also much better your requirements.

Maximized RSI Strategy | Coinrule Best Strategies

A long-term approach to buy reduced and offer high using the Relative Strength Index indicator.

Buy Low and Sell High is every investor’s concept. While this technique looks simple in theory, it’s sometimes challenging to place it right into the method. That calls for cold-blood and also stress-management to purchase when the rate declines. But that is not enough. You will also need resolution in marketing when the price is rising.

RSI is a valuable tool to apply long-lasting as well as efficient trading approaches. Catching the appropriate time to get the dip may be tricky. This automatic trading approach is made the most of variation of a common RSI trading system.

How does it work?

The technique buys when the RSI is lower than 35, and also at the very same time, the price is below the MA100. This means the bot will not acquire the dip also early, boosting the productivity of the technique.

The position shuts when the RSI worth is over 65. Relying on the coins’ volatility that the strategy will trade, it’s possible to adjust the RSI exit worth to go after bigger profits. In times of Bull Market, the RSI can likewise be above 70.

The configuration is maximized on a 15-minutes time structure and also trading cryptocurrencies versus USD or secure coins.

Why Maximized

The following are the outcomes of two backtests on the very same coin over the exact same duration. In both instances, the strategy buys with worths of RSI lower than 35.

In one situation, the technique gets when the price is above the Moving Average 100:

In the other instance, the buy signal comes with a price below the Moving Average 100:

The outcomes show that excluding trading when the price is over the Moving Average 100 allows the approach to trade only when it’s more lucrative.

Backtest the technique on Tradingview

You can backtest this technique utilizing this trading script published on Tradingview. You can test the results on historical information, selecting the coin of your option, as well as changing the parameters to fit also better your requirements.

Low Volatility Buy And Sell | Coinrule Best Strategies

Do not follow the pattern, anticipate it! The rule assists you in finding convenient buy possibilities every day.

When a coin’s volatility lowers, purchasers and also vendors are normally stabilizing each other forces in the marketplace. Once this stability finishes, the rate can experience strong steps. If the price rises from there, that might be a very fascinating acquiring chance.

You can utilize Moving Averages to capture that occasion.

How does it work?

A method to discover times with low volatility and the potential for the price to leap is to make use of a details arrangement of Moving Averages to be near each other.

You can run the rule throughout multiple coins, or conversely, you can pick a single coin you want to trade in the long-term. In this situation, the rule will certainly trade less frequently, however, you will certainly have greater control.

Pro-tip: this coinrule template can work well mostly in all market conditions, leaving out times when the marketplace is trending down for extended periods.

The arrangement to spot times of low volatility

The strategy purchases when 3 relocating averages (the MA50, MA100, and MA200) have the following arrangement:

- The MA200 is above the MA100, implying that the coin is moving sidewards or in a downtrend

- The MA50 is higher than the MA100, meaning that there are early indicators of an uptrend.

The best timing for this arrangement is the 1-hour, however, it can also work well on the 4-hour.

Safeguard your trades

The bot shields all your trades to decrease the risk of losses and take advantage of the profit if the price boosts.

The system sells the coin when among both following circumstances happen:

- the price decreases 3% from the entry rate, as a stop loss

- the price boosts 6% from the entry get price, as a take profit.

The outright profit on each trade finished effectively extra than makes up the trades in a loss for a far better risk-management of the funds.

Backtest the strategy on Tradingview

You can backtest this strategy utilizing this trading script published on Tradingview. You can evaluate the results on historical information, picking the coin of your choice, and also readjusting the parameters to fit even much better your needs.

Bitcoin Trading In Sideways Market | Coinrule Best Strategies

The finest strategy to trade Bitcoin when it relocates sideways with no solid trend swings.

Traders wait for solid rate movements to make earnings. They purchase, preparing for rate rises, or offer to secure from the threat of dips. The reality is that the majority of the time, the price actions reasonably sidewards in no clear direction. Suppose you could additionally benefit from those problems without the need for sitting and also awaiting breakouts?

Trying to prepare for a solid trend might be rewarding yet dangerous at the exact same time. Greater volatility might create anxiety leading to obtaining stuck with sell loss, awaiting the next possibility.

When volatility is lower and also the price actions sidewards, you can predict easier the price activity and develop the finest system to fit the marketplace.

How does it work?

After a sharp price step, durations of consolidation comply with for some time, and the asset trade laterally. That is an excellent time to trade swings on low volatility.

These are the times when trading by hand is a lot more difficult, while automated trading approaches can add substantial value.

You can identify when it’s better to start an approach when the rate does not make even more higher-highs on the trend. That implies the uptrend is damaging, and scalping brief-term trades on the drawback has an excellent risk reward.

The technique

The trading system prepares to offer Bitcoin on price increases. You can readjust the portions based on the frequency of trades you desire to achieve. Bigger portions will execute orders less frequently.

Bear in mind, the concept of this approach is to trade low volatility, sharp price rises or declines may revoke the thesis making the coinrule template temporarily ineffective.

When the price decreases, the rule redeems Bitcoin at a lower price when the trend returns in the short-term.

Keep in mind: If Bitcoin is carrying on the downside, the percentage for acquiring back can be a little greater than the one that set off the sell order to optimize the outcomes.

Buy The Dips In Bull Market | Coinrule Best Strategies

A strategy to make use of temporary possibilities in a Bull market

During a Bull market, trading strategies that acquire the dips on coins represent one of the best means to browse the trend and also maximize the returns.

When the price drops, it’s testing to expect exactly when the rate will certainly rebound. Also in solid trending markets, the rate periodically turns around strongly, using great buy opportunities. The RSI is an outstanding tool to capture price drops as it readjusts the entry to the asset’s existing volatility. You can learn more regarding exactly how the RSI operates in this article.

This method attempts to catch really short-term possibilities to stop staying in embedded settings for extended periods.

How does it work?

The coinrule template buys when the RSI worth is lower than 35 in a time structure of 15 mins. That isn’t an indicator that the key pattern is activating the downside and also can be a good acquiring chance.

The strategy then sells when the rate is back on-trend. To identify this, the condition for marketing is

You can find out more about how to make use of Moving Averages here.

Pro-tip: this is a lasting method that carries out on all coins. By default, the rule opens up one trade at once, however you can enhance the trade regularity using the Any Time Operator.

The finest dips to purchase in a Bull market

The bot buys the coin when the price experiences a decline, however, the MA9 is still above the MA200. That shows that the trend is strong, as well as there are likelihoods for a rebound.

- RSI is lower than 35 in a 15-minutes amount of time

- the MA9 is above the MA200 in a 15-minutes amount of time

Seize the gain

Closing the trade rapidly reduces the danger of missing the profit and enables the bot to begin looking for the following opportunity on the market.

When the coin rebounds, the technique offers and carries on to the next coin. A Bull market offers several chances every day.

- MA9 to be over the MA50

- The price to be above the MA9

Backtest the approach on Tradingview

You can backtest this approach using this trading script published on Tradingview. You can check the results on historic information, selecting the coin of your option, and also adjusting the specifications to fit even much better your needs.

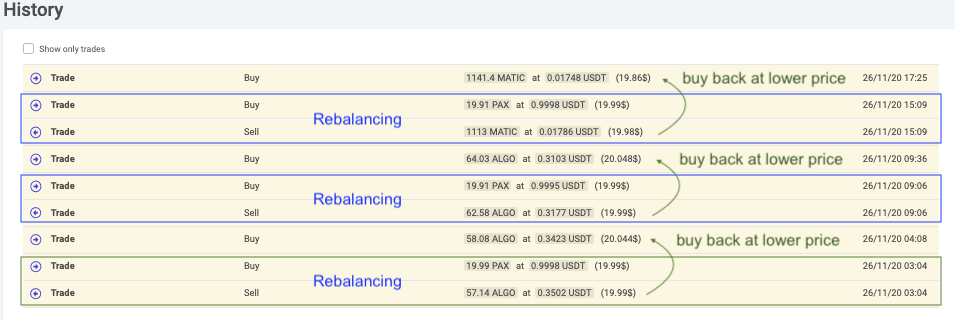

Rebalance Trend Following | Coinrule Best Strategies

This approach makes it very simple to rebalance your wallet in a bull market, capitalizing on the day-to-day volatility of cryptocurrencies.

Trading in bull markets can be as difficult as handling your properties during downtrends. Crypto markets trade 24/7, and reacting at any price relocate’s challenging. This technique makes it very easy to rebalance the coins in your wallet in a bull market, making use of the everyday volatility.

Daily Rebalancing

Just how numerous times every day do you examine the prices of your coins? Each price rise attracts you to sell to take some profit. On the other hand, you tend to stick to those coins underperforming, really hoping that they will rebound soon. The fact is that during a bull market, the finest method is to comply with the pattern.

As price steps promptly at any time of the day, it’s practically impossible to catch up with all the market possibilities. This technique is the perfect auto-pilot for your wallet in a bull market.

Occasionally, the coinrule template offers the coins in your wallet underperforming as well as makes use of the allotment to get those with the greatest price boost.

Take Profit To Optimize The Return

The method can after that conversely redeem or market in profit the coins previously traded for every single rebalancing occasion.

Bull markets are usually extremely directional. Sharp price drops break long streaks of rate rises. After the short-term dips, the rate usually rebounds strongly, making feeling to shop back the coins marketed.

This system combines a rebalancing technique based on coins’ day-to-day wallet performances with temporary tactical trades to improve the returns.

Full control of your assets

There are two benefits of using this method.

This coinrule template is that it’s not demanding in terms of capital to invest. This makes it simpler to have offered resources for other online strategies. If you pick the same wallet across all the actions, the rebalancing occurs with no need for added resources besides the coins traded.

A little amount of funding is only required to ensure the coinrule template has enough funds to purchase back the coins offered in the previous rebalancing activity.

One more interesting benefit is to avoid contributing to your wallet undesirable coins. You choose which coins to hold. The method just adjusts the amounts based upon the market volatility to optimize the wallet return.

However, if you intend to manipulate much more possibilities you can run this strategy in parallel with various other rules. You can gather your favoured coins and let this rebalance them instantly in your wallet.

An additional option would certainly be to get the very best executing coin on the market every day with a take profit. If that coin has a price drops the take profit will not apply yet this coinrule template will manage it, selling it if it will underperform various other coins in your wallet.

How to construct the method on Coinrule?

When the price volatility is high, trading manually can be extremely tough and also demanding. This coinrule template to rebalance your wallet in an advancing market strategy enables you to capture even more opportunities. You can adjust the frequency of the rebalancing activities according to your choices.

This is a guide to learn exactly how to backtest approaches on Tradingview.

That’s it! Enjoyed? Which will be the Coinrule Template you’ll test? Tell us!

Recent Comments