Table of Contents

The $42B Fraud Prevention Challenge

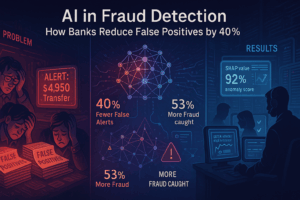

Financial institutions lose $42B annually to payment fraud (Nilson Report, 2024), while simultaneously wasting $3.7B investigating false alarms.

Traditional rules-based systems flag ~15% of transactions for review, but 72% of these alerts are false positives (ACAMS, 2023).

This article reveals how banks like HSBC and BGL BNP Paribas use AI to:

- Cut false positives by 40%

- Detect 53% more fraud (IBM, 2024)

- Reduce investigation time from hours to seconds

1. The Flaws in Traditional Fraud Systems

Problem 1: Rigid Rules Can’t Keep Up

Example: A rule like “Flag transactions >$5,000” misses:

- Small, rapid thefts (“micro-fraud”)

- Behavioral anomalies (e.g., unusual login location)

Result: Only 12% of fraud is caught by rules alone (Javelin, 2024).

“Fraudsters reverse-engineer rules within weeks. One bank found criminals making $4,950 transfers to bypass $5k triggers. Static systems create a false sense of security.”

Problem 2: Alert Fatigue

Analysts review 300–500 alerts/day—leading to 17% missed fraud due to cognitive overload (Association of Certified Fraud Examiners).

Cost: Each false alert costs $15–$25 in labor (Forrester).

2. How AI Solves This: 3 Advanced Techniques

Technique 1: Anomaly Detection with Unsupervised ML

How it works:

- Models like Isolation Forests and Autoencoders learn normal customer behavior.

- Flags deviations (e.g., sudden $10k transfer from a typically inactive account).

Case Study: BGL BNP Paribas

- Reduced false positives by 40% using Dataiku’s anomaly detection.

- Key feature: “Patient Zero” analysis finds connected fraud patterns.

“Unsupervised models excel at detecting never-before-seen fraud types. But they require at least 6 months of clean historical data to establish baselines.”

Technique 2: Graph Networks for Organized Crime

How it works:

- Maps relationships between accounts, devices, and IPs.

- Uncovers mule networks and layering schemes.

Example: HSBC’s AI System

- Detected a $90M laundering ring via:

- Device fingerprinting

- Transaction timing patterns

- Increased true positives by 35% (HSBC, 2023).

“Graph analytics is revolutionary for AML. But beware—overly dense networks can trigger false links. Set relationship thresholds (e.g., ≥3 shared nodes) to reduce noise.”

Technique 3: Ensemble Learning with Real-Time Feedback

How it works:

- Combines 5–7 models (e.g., Random Forest + Neural Nets).

- Continuously retrains using investigator decisions.

Results at JPMorgan Chase:

- 53% more fraud caught

- 30% faster investigations via automated suspicious activity reports (SARs)

“Ensemble models outperform single algorithms by 15–20% (IEEE, 2024). But they’re computationally expensive—use cloud GPUs for inference.”

3. Implementation Roadmap

Phase 1: Data Preparation (4–6 Weeks)

| Task | Tools | Cost |

|---|---|---|

| Transaction history | Snowflake, BigQuery | $20K–$50K |

| Behavioral biometrics | ThreatMetrix, BioCatch | $100K+/year |

“Prioritize data quality over quantity. One bank wasted $250K on unusable IoT device data.”

Phase 2: Model Development (8–12 Weeks)

- Start simple: Logistic regression baseline

- Add complexity: Graph networks for high-risk segments

- Validate: Use F2-score (balances precision/recall)

Phase 3: Deployment

- Pilot: 5% of transactions

- Shadow mode: Run AI parallel to legacy systems

- Go live: Route only high-confidence alerts to analysts

4. The Future: Explainable AI (XAI) for Compliance

- Regulatory requirement: EU’s AI Act mandates fraud AI be interpretable.

- Solution: SHAP values/LIME show why transactions were flagged.

Example:

“Alert triggered due to:

1. 92% unusual amount for this payee

2. 88% mismatch with user’s typical login time”

Conclusion: Your 90-Day Action Plan

- Audit current systems: What % of alerts are false positives?

- Pick one high-impact area: Start with credit card fraud.

- Build cross-functional team: Fraud ops + data science + compliance.

Recent Comments