Stablecoins are a type of cryptocurrency designed to maintain a stable value over time, in contrast to the high volatility commonly associated with cryptocurrencies like Bitcoin and Ethereum. This stability is typically achieved by pegging the stablecoin’s value to a stable asset, such as the US dollar, another fiat currency, or a commodity like gold.

Table of Contents

How Do Stablecoins Work?

Stablecoins maintain their stability through various mechanisms:

- Fiat-Collateralized Stablecoins: These are backed by a reserve of fiat currency, like the US dollar. For every stablecoin issued, an equivalent amount of fiat currency is kept in reserve. Examples include Tether (USDT) and USD Coin (USDC).

- Crypto-Collateralized Stablecoins: These stablecoins are backed by other cryptocurrencies, but they are often over-collateralized to absorb price fluctuations in the backing crypto assets. MakerDAO’s DAI is a popular example.

- Algorithmic Stablecoins: These are not backed by any asset but use a working mechanism, such as smart contracts, to control the supply of the stablecoin, depending on its demand, to maintain a stable value.

The Market of Stablecoins

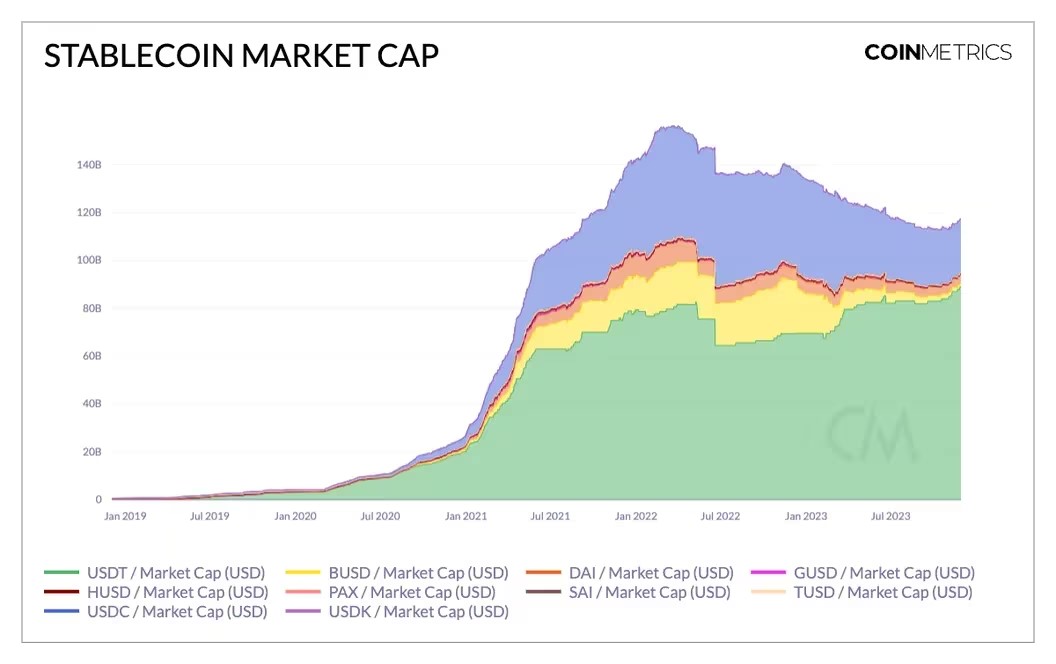

The market for stablecoins has grown rapidly, becoming an integral part of the cryptocurrency ecosystem. According to Glassnode, the total market cap of the biggest stablecoins has reached around $124 billion.

Stablecoins offer a haven during periods of high volatility in the crypto market and facilitate transactions and trading. The market cap of stablecoins like Tether and USD Coin has reached billions, reflecting their growing acceptance and use.

What are the top Stablecoins in the market?

The most popular stablecoins, recognized for their widespread use and significant market capitalization, include:

- Tether (USDT): Tether is arguably the most well-known stablecoin and has the highest market capitalization of almost $92 billion among its peers. It’s pegged to the US Dollar and claims to be backed by an equivalent amount of traditional fiat currencies held in reserves.

- USD Coin (USDC): USD Coin, issued by Circle and Coinbase, is another leading stablecoin also pegged to the US Dollar. USDC has a market cap of almost $24.7 billion. It has gained popularity for its transparency and regular audits, ensuring that each coin is indeed backed by one US Dollar held in reserve.

- Dai (DAI): Dai is a decentralized, crypto-collateralized stablecoin managed by the MakerDAO system. It has a market cap of almost $5 billion. Unlike others pegged directly to fiat reserves, Dai maintains its peg through a dynamic system of smart contracts and collateral in the form of other cryptocurrencies.

- Binance USD (BUSD): Developed by Binance in partnership with Paxos, BUSD is a stablecoin pegged to the US Dollar, with a market cap of almost $1 billion. It is widely used within the Binance exchange and is known for its regulatory compliance.

- TrueUSD (TUSD): TrueUSD is another US Dollar-pegged stablecoin. It is known for its full collateral, legal protection, and regular auditing. TUSD has a market cap of $2.3 billion. This stablecoin aims to provide high levels of trust and transparency.

These stablecoins play a crucial role in the cryptocurrency market by providing a less volatile option for traders and investors. They enable easier transactions, are often used as a safe haven during periods of high market volatility, and serve as a gateway for many decentralized finance (DeFi) applications.

It’s important to stay updated with the latest developments in the crypto space, as the popularity and reliability of various stablecoins can change over time due to market dynamics, regulatory changes, and technological advancements.

Future Prospects

The future of stablecoins appears promising but faces regulatory challenges. As they bridge the gap between traditional finance and cryptocurrencies, regulators worldwide are keenly observing and planning to establish frameworks to manage the potential risks associated with stablecoins, like financial stability and consumer protection.

Real-World Use Cases

- Remittances and Money Transfers: Stablecoins provide a cost-effective, fast, and secure means for cross-border money transfers, especially in regions with unstable currencies.

- Trade and Commerce: Merchants and businesses are increasingly accepting stablecoins for transactions, appreciating their stability compared to other cryptocurrencies.

- Decentralized Finance (DeFi): Stablecoins are pivotal in the DeFi ecosystem, enabling lending, borrowing, and yield farming without the volatility of typical cryptocurrencies.

- Hedging Against Volatility: Investors and traders use stablecoins to safeguard their assets against the high volatility of the crypto market.

Conclusion

Stablecoins represent a significant innovation in the cryptocurrency space, providing stability, efficiency, and a bridge to the traditional financial system. Their growth and adoption are expected to continue, albeit under a more regulated framework, as they find more applications in real-world financial transactions and DeFi.

Recent Comments