In a world where traditional banking systems often feel like monolithic giants, slow to adapt and rigid in their processes, alternative lending emerges as a nimble David to the Goliath of conventional finance. This sector is reshaping the financial landscape, offering a beacon of hope to those often sidelined by mainstream financial institutions.

Table of Contents

What is Alternative Lending?

Alternative lending refers to non-traditional financial services offered outside the conventional banking system. This includes peer-to-peer platforms, online lenders, crowdfunding, microfinance institutions, and fintech firms. These entities leverage technology to streamline lending processes, offering quicker, more accessible, and often less stringent financial solutions to individuals and businesses alike.

The Rising Tide of Market Share

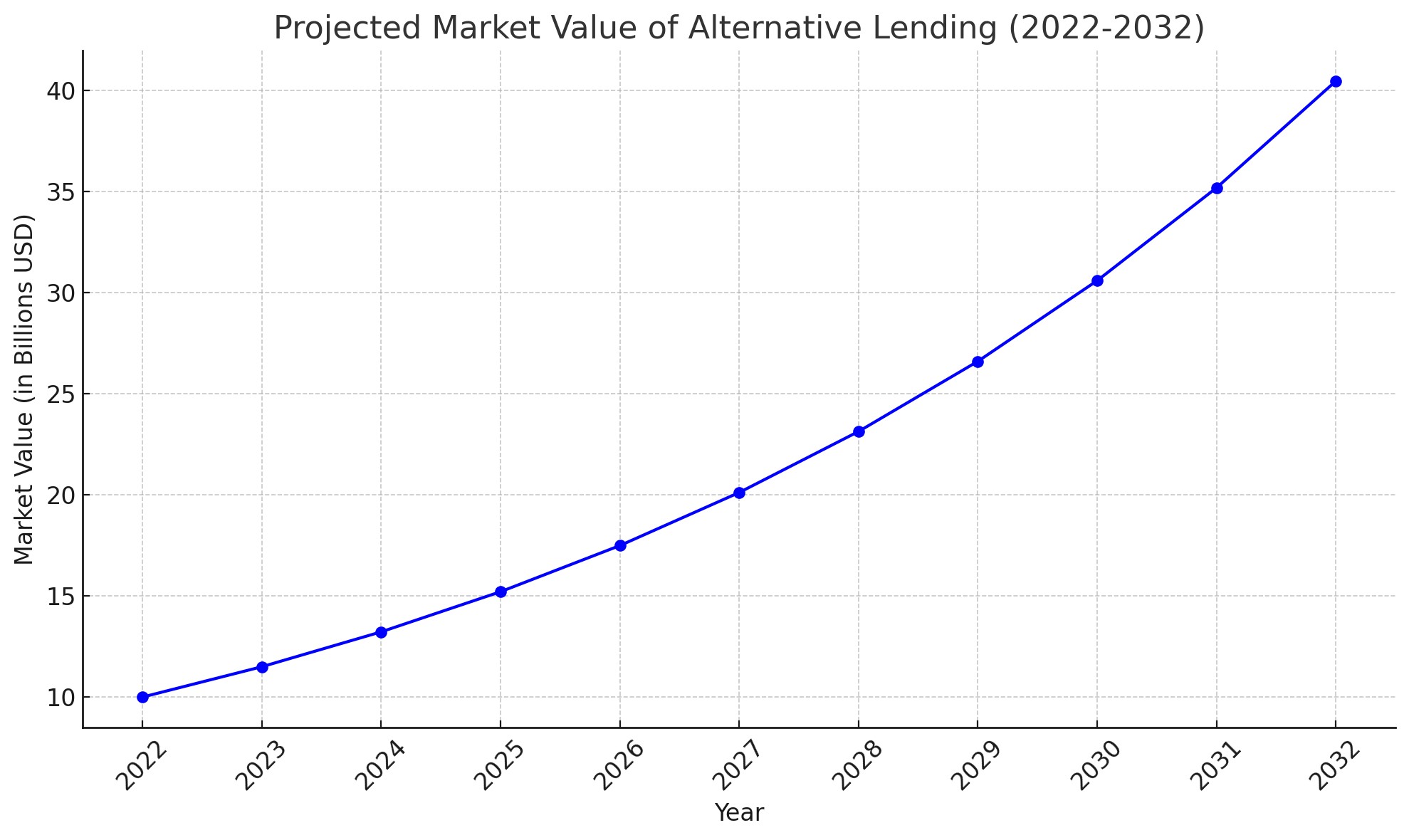

The market share of alternative lending is rapidly increasing, propelled by technological advancements and a growing appetite for more user-friendly, customizable and inclusive financing options. As of 2022, the market value of the whole sector was almost $10 billion. The sector is expected to grow with a CAGR of 15% between 2023 and 2032.

Starting from a base value of approximately $10 billion in 2022, the market is expected to experience significant growth year-on-year. As shown in the graph above, this growth trajectory is quite steep, indicating a robust expansion of the sector. By 2032, the market value is projected to reach substantially higher levels, showcasing the increasing influence and importance of alternative lending in the financial landscape. While this is just a projection, the real growth curve may be steeper than this.

This growth can be attributed to factors such as technological advancements and a growing demand for more accessible, user-friendly financing options.

Use Cases

Globally, alternative lending has scripted numerous use cases and success tales. These innovative approaches have changed how individuals and businesses access capital, providing more inclusive and efficient financial solutions.

Peer-to-Peer (P2P) Lending in Small Businesses Growth

Small businesses, often struggling to secure loans from traditional banks, have found a lifeline in P2P lending platforms. For example, Funding Circle, a leading P2P lending platform, has facilitated over $10 billion in loans to small businesses globally. This has not only aided the growth of these businesses but also contributed to economic development and job creation in their respective communities.

Microfinance in Developing Countries

In regions like Southeast Asia and Sub-Saharan Africa, microfinance institutions (MFIs) have revolutionized access to finance for low-income individuals and entrepreneurs. For instance, Grameen Bank in Bangladesh has provided microloans to millions, primarily women, helping them start or expand businesses, thereby elevating their socio-economic status and fostering community development. Similarly, Akhuwat, which is a microfinance NGO in Pakistan since 2001, has been working for poverty alleviation. While these two MFIs have seen global acclaim, they are yet to step into the fintech world to take advantage of it. Probably the only hindrance that charity MFIs have is that the fintech alternative lending industry is gearing on a business model, whereas NGOs run on charity. Once this hiccup is figured out, we can see an explosion of NGO MFIs in the alternative lending space.

Crowdfunding for Innovative Projects

Crowdfunding platforms like Kickstarter and Indiegogo have become hotbeds for innovation, allowing creators to fund projects directly through community support. This has led to the successful launch of numerous innovative products and services. For example, the Pebble Smartwatch raised over $10 million on Kickstarter, demonstrating the platform’s capacity to bring groundbreaking ideas to market.

Online Lenders in Credit Accessibility

Online lending platforms have significantly increased credit accessibility, especially for consumers and businesses with limited credit history or lower credit scores. Platforms like LendingClub and Prosper offer personal and business loans with more flexible eligibility criteria compared to traditional banks, thus widening the net of financial inclusion. They have not only helped individuals but also helped create a whole ecosystem of small businesses that now have access to capital without going to conventional banks.

Debt Consolidation Loans

Alternative lending has also been instrumental in helping individuals consolidate high-interest debt. By offering debt consolidation loans, these platforms enable users to combine multiple debts into a single loan with potentially lower interest rates, simplifying debt management and often reducing the total interest paid over time.

Each of these use cases demonstrates how alternative lending has not only disrupted traditional financial models but also created tangible positive impacts, from empowering small business owners and entrepreneurs to facilitating innovative projects and enhancing financial inclusion globally.

The Darker Side: Scams and Pitfalls

However, where there is light, shadows loom. The alternative lending landscape is not immune to malpractices. Instances of scam lenders have surfaced, exploiting the less regulated nature of this sector. Victims, often those desperate for financial aid, have been duped into losing their money, ensnared by promises of easy loans and quick cash.

These examples highlight the potential risks and areas of improvement for startups in this sector.

High-Interest Rates and Debt Traps

Some alternative lending platforms have been criticized for charging exorbitantly high interest rates, leading borrowers into debt traps. For instance, payday loans, often offered by alternative lenders, can have annual percentage rates (APRs) as high as 400%. This can lead to a cycle of debt for borrowers who are unable to repay these high-cost loans.

Predatory Lending Practices

Certain alternative lenders have engaged in predatory lending practices, targeting vulnerable borrowers with poor credit histories. These lenders often conceal the full cost of loans or employ aggressive marketing tactics to lure borrowers into unfavorable terms. The U.S. Consumer Financial Protection Bureau (CFPB) has taken action against several such lenders for deceptive practices. India, Pakistan, and Indonesia have also seen a rise in predatory lending apps, in the absence of a regulatory framework.

P2P Lending Platform Failures

Some peer-to-peer lending platforms have failed, leaving investors with significant losses. For example, the collapse of the Lendy platform in the UK resulted in losses for thousands of investors. Such failures raise concerns about the risk assessment and management practices of some P2P lending platforms.

Crowdfunding Scams

Crowdfunding platforms, while fostering innovation, have also been used for fraudulent projects. There have been instances where project creators collected funds from backers and then failed to deliver on their promises, either due to mismanagement or deliberate scams. This has led to a loss of trust among backers in some cases.

Data Security and Privacy Concerns

With alternative lending largely operating online, there’s an inherent risk of data breaches and privacy concerns. There have been instances where alternative lending companies have mishandled sensitive personal and financial information, leading to privacy violations and risks of identity theft for borrowers.

These negative use cases underscore the need for robust regulatory frameworks and increased awareness among borrowers regarding the potential risks associated with alternative lending. While it offers numerous benefits, the sector also demands caution and informed decision-making to avoid adverse outcomes.

The Imperative of Financial Literacy

This underscores the crucial need for personal financial management education. Prospective borrowers must be equipped with the knowledge to navigate this new financial terrain wisely. Understanding the implications of their financial decisions is important. Below are some points that borrowers should keep in mind before utilizing the services of any alternative lender.

Interest Rates and Fees

It’s vital to comprehend the interest rates and fees associated with alternative loans. Unlike traditional banks, some alternative lenders might charge higher rates or have different fee structures. Borrowers should understand how these rates are calculated and the impact they have on the total cost of the loan.

Repayment Terms and Flexibility

Prospective borrowers should familiarize themselves with the repayment terms offered by alternative lenders. This includes understanding the loan duration, monthly repayment amounts, and any flexibility in repayment, such as the ability to prepay without penalties.

Risk of Overindebtedness

Alternative lending can sometimes lead to easy access to credit, creating a risk of overindebtedness. Individuals need to assess their capacity to repay before taking out loans, considering their income, existing debts, and financial obligations.

Credit Scores and Reporting

Borrowers should understand how alternative lending affects their credit scores. Some alternative lenders report to credit bureaus, while others do not. Knowing this can help in managing credit history effectively.

Predatory Lending Practices

Awareness of predatory lending practices is crucial. This includes recognizing red flags such as high-pressure sales tactics, unclear loan terms, and loans that seem too good to be true. Borrowers should be wary of lenders who do not perform credit checks or who offer loans without a clear repayment plan.

Regulatory Framework and Consumer Rights

Understanding the regulatory environment and consumer rights in the context of alternative lending is important. This includes knowing what legal protections are in place and what recourse is available in case of disputes or grievances.

Data Security and Privacy

Since alternative lending often involves sharing personal and financial information online, knowledge about the data security and privacy practices of the lender is essential. Borrowers should ensure that their data is handled securely and understand the privacy policies of the lending platform.

Comparison Shopping

Before settling on a lender, it’s advisable to shop around and compare different options. This includes comparing interest rates, fees, terms, and customer reviews to find the best fit for one’s financial situation.

By equipping themselves with these crucial points of personal finance, individuals can make more informed decisions when engaging with alternative lenders, effectively balancing the convenience and innovation of these services with a cautious approach to financial management.

Looking Ahead: The Future of Alternative Lending

The prospects of alternative lending in the future remain bright but cautious. With increasing regulatory oversight technological advancements and financial decentralization, the sector is set for sustainable growth. Innovations in AI and blockchain promise enhanced security and efficiency, potentially mitigating risks and elevating trust.

Recent Comments