Table of Contents

What is Soldo? | Soldo Review

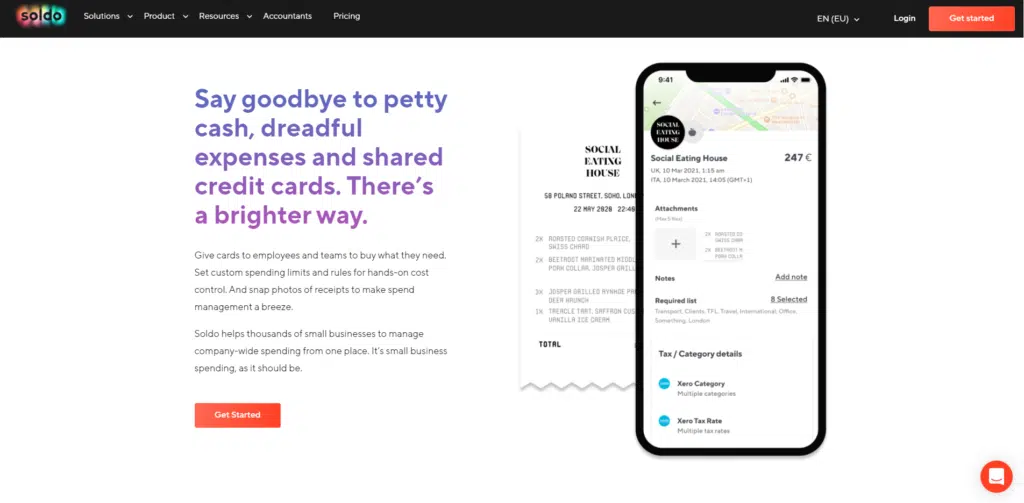

Soldo is a spending control and management platform that aims to ease the pain points of business expenses. Soldo combines banking, accounting and admin features to help you keep an eye on principal business payments and petty cash costs across multiple user profiles.

While not a bank itself, the platform can be used by businesses of all sizes, provided they have issues managing their business expenditure and want more efficient performance in that area.

Soldo splits its main product offerings by enterprises (100+ employees) and small businesses (1-99 employees).

It enables departments and employees to make purchases – from travel expenses to software to advertising to eCommerce; control costs with custom budgets and monitor transactions in real-time; link accounting software to automate reporting and save time, then use insights to grow.

How Does Soldo Work?

Soldo makes it super easy to manage your business expenses in one central hub.

- You can easily create your Soldo account by selecting a plan that fits your company’s needs and filling out information about yourself and your business.

- After signing up, you’re required to top up your Soldo account. You can transfer cash from your business’s main account to a spending account in your company’s name.

- After going through the setup process, it’s time to start organising your finances. You can use the app to create as many users as you want among your workers, provide each with a prepaid Mastercard card and start allocating money to different employees who will use the money for their expenses.

- You can personalise the prepaid cards with the employee’s name and, through your Soldo platform, log all of your distributed cards onto the system.

- Your employees can add snaps of the transaction receipts and tag them according to a selected set of categories.

- When a transaction happens, you’ll receive a notification and spending reports, which you can export to spreadsheets and upload to your accounting software.

Soldo App

The native Soldo mobile app comes with a series of features such as reports and real-time notifications to help you track your spending.

The app also lets you make changes to your expense accounts on the go. Suppose you’re out of the country for business and you need to increase the card limit for a particular employee. In that case, you can do this at the click of a button.

This app is free to download across both Android and iOS devices

Who Owns Soldo?

Soldo was founded in 2015 by Carlo Gualandri. The mission was to build the world’s first multi-user spend control solution.

The company was initially aimed at consumers. But after raising $11 million in funding, Soldo expanded their offering to help companies of all sizes manage business spending in a smarter, more efficient way.

Soldo is headquartered in London but also has offices in Milan, Rome and Dublin.

Soldo Statistics

Soldo has grown from a core product-obsessed crew to a diverse team (210+ people of 21 nationalities) intent on revolutionising business spending.

Soldo is currently available in the UK, Italy and the rest of the European Economic Area (EEA). They help over 26k businesses across Europe to spend smarter.

The company has plans to increase the number of countries it supports in the very near future.

Banking Features on Soldo | Soldo Review

Soldo has a diverse range of banking features that can make managing your company expenses and financials a breeze.

Expense Management on Soldo

Soldo tracks spending in real-time.

When one of your employees incurs an expense, you will receive an instant notification with details about the spender, the amount and the nature of the payment.

For accounting purposes, the cardholder can take a snapshot of the receipt as proof of payment with their smartphone. No more wasting time taking receipts to the accounts department and then having them updated.

The reconciliation process, which traditionally took several days to complete can now be done in hours.

This system also helps in making the audit process more open.

Reports and Analysis on Soldo

Soldo reports make it easy to generate custom reports.

You can see how much has been spent over a certain period by downloading statements and then break down the info to get useful insights.

Additionally, you can generate transaction reports that can then be categorised by implementing filters.

Transaction reports will let you easily analyse where the bulk of your expenses are going and the particular employees making the most purchases.

Accounting Software Integration with Soldo

Soldo has no accounting tools of its own. Still, Soldo makes expense reconciliation effortless, thanks to its seamless integration with all the popular accounting systems such as Xero, QuickBooks Online, Microsoft Dynamics, SAP, Sage and Netsuite.

Transferring data manually is tedious and prone to human error. With just a single click, you can transfer transaction data, including categories, notes, receipts and much more quickly and effortlessly.

Formats you can export your data include QIF, CSV, XLSX and OFX. These formats are compatible with any accounting software.

Contactless Prepaid Cards on Soldo

You can get as many prepaid Mastercard cards as you wish and give them directly to your staff and contractors.

Since they’re prepaid cards, you will only have to load as much money as the employee you’re giving it to is expected to spend.

Cardholders can use them for contactless transactions subject to authentication requirements.

The cards come in three different currencies: Sterling, Dollar or Euro.

Soldo Automatic Prepaid Card Top-ups

To ensure your employees never run out of money when they need it most, Soldo allows you to add funds to a card automatically.

Setting up recurring monthly top-ups is advisable if your employees’ spending is predictable. This is a great timesaver over doing it manually.

From the web console, it’s easy to set up the auto top-ups for each card user. Simply select the card user, specify the account the money will come from and the amount to add.

To keep yourself from abusing this feature, you can limit the maximum transfers for a specified period.

Soldo Receipt Capture

As mentioned, cardholders can use their smartphones to capture a picture of the receipt.

Soldo will, by design, attach the snapshot of the ticket to the transaction.

Thanks to this feature, keeping track of physical receipts and matching them with the right transactions is no longer necessary.

The accounting department can also benefit from having updated records without waiting for employees to submit their claims.

Bespoke Spending and Rules on Soldo

Thanks to the predefined budget limits, it’s impossible for employees to run up debt. There’s no overdraft option.

You can set individual limits for each card and stipulate card usage policies. The card will echo these limitations and restrictions for each user.

Creating monthly, weekly and daily spending limits gives you total control over your employees’ expenses. And get this, you can change the limits when necessary!

Thanks to the app, responding to urgent spending needs while on the go is now possible.

Soldo Roles and Permissions

To help you manage what employees can and can’t do, Soldo uses permissions.

There are five roles that can be granted to your employees. Each role comes with a different set of licences:

- Employee – can add transaction details, manage their cards and add reports of their activities.

- Accountant – use integrations to access the reports and manage tags. They only handle the info, not the money.

- Manager – review employees’ transactions and see that they’re spending according to the policy.

- Admins – can access all features but cannot set permissions for users.

- SuperAdmins – can manage users, cards, wallets and expense centres.

Using Soldo Overseas | Soldo Review

Over 30 million Mastercard outlets and 1.5 million ATMs around the world will accept your Soldo card. Since most online merchants accept Mastercard, your virtual Soldo card will enjoy the same flexibility.

To secure your funds, there are limits to cash withdrawals and your purchases. These restrictions are put in place so you won’t get yourself in a situation of not being able to buy what you need.

Soldo Pros and Cons | Soldo Review

Like any other financial product, Soldo has many benefits and a few downsides.

Soldo Pros

- A basic free plan if you want to test the waters

- It combines banking and expense management

- Has useful real-time tracking features that will help you stay on top of your expenses

- You can have as many cards and users as you want

- You can export data to your accounting software with a few clicks

- Offers virtual cards for safer online shopping

- Safeguard limits to cash withdrawals and purchases

- Comes with both a web interface and a handy app

- Five-tiered permission scheme

Soldo Cons

- You will need a regular business bank account to fulfil all your financial needs

- You will still need to pay foreign transaction and ATM withdrawal fees on top of the monthly one

- Deposits not FCSC-protected

Soldo’s Security and Privacy? | Soldo Review

While it’s not a bank, Soldo has an electronic money licence and is regulated by the Financial Conduct Authority. The FCA sets strict rules related to dedicated finances and assures safety to the customers.

Where is my Money Held on Soldo?

Your money is reserved in segregated accounts, meaning that should something happen to Soldo, the money can’t be used to pay its creditors.

The funds are safeguarded under the 2017 UK Electronic Money Regulations.

If any of your prepaid card is stolen or lost, you can instantly block its functionalities from the app.

Is My Data Safe With Soldo?

Data security is of utmost importance.

Soldo doesn’t share your financial or personal information with third parties.

Soldo claims to only collecting the data necessary for service performance (legal obligations and contract execution).

How Secure is Soldo? What Guarantees do I Have with Soldo?

The Soldo tech infrastructure exceeds the set standards of security, stability and integrity.

Their systems are designed for maximum uptime via an architecture that concurrently accepts payments on several availability zones.

All security activities, development and system administration are performed in house by Soldo experts.

All of Soldo’s data is stored in Europe, and the platform is fully PCI DSS 3.2 compliant as a Level 1 Service Provider – the payments industry’s key security standard.

Is Soldo Regulated? | Soldo Review

Soldo follows strict compliance processes.

They’re authorised and regulated by the FCA as an e-money institution under the Electronic Money Regulations 2011 (ref: 900459).

This allows them to hold their customers’ money and execute payment services.

Soldo doesn’t lend or take risks with their customers’ money; they access it solely to execute their transactions.

Your funds are always protected because they’re completely independent of the Soldo company accounts and assets and are secured in a ring-fenced account in leading financial institutions in each market.

Soldo Plans and Fees | Soldo Review

As of this writing, Soldo offers four different pricing plans: Soldo Uno, Soldo Pro, Soldo Premium and Soldo Custom.

How Much Does Soldo Cost?

It depends on the plan you choose.

Soldo doesn’t charge any fees for domestic transactions. The money you transfer to a wallet is precisely the same as the maximum amount the cardholder can spend.

Putting funds to your Soldo account from a domestic bank account and moving funds from the admin console is free and instantaneous.

Soldo Uno – This is the basic tier that Soldo offers. It’s limited to one card (plastic or virtual).

Features include:

- Free deposits and withdrawals from domestic accounts

- Spending controls (limits, rules and budgets)

- Accounting integrations with QuickBooks Online, Xero and CSV exports to all other accounting platforms

- Mobile app and administrative web console

- On-the-spot receipt capture and enriched transaction data

- Instant and free fund transfers to users

- 2 per cent FX fees for foreign transactions

- Live customer support

Soldo Pro – Instead of paying a fixed amount of money every month, the Soldo Pro plan actually charges you on a per-card basis (£6 per month per card).

If, for instance, you have 30 employees using a prepaid card in any given month, you’ll pay a total of £180 (30x £6). This, at the very least, lets you minimise your monthly spend if you need to reduce the number of cards in circulation.

The mid-tier comes with everything that Soldo Uno comes with, plus:

- Up to 20 cards (plastic and virtual)

- Dedicated account number and sort code for inbound payments

- Spending controls for each user (limits, rules and budgets)

- Comprehensive reporting

- Automatic card top-ups

- 1 per cent FX fees for foreign transactions

- Permissions and roles for users

Soldo Premium – For £10 per month per active card, you can get this step-up plan designed for growing businesses.

The main difference between the Soldo Pro and Premium plans is that you enjoy a higher level of reporting capabilities, plus you can also execute custom configurations of business roles.

Take control and visibility a notch higher with cutting-edge tools to fit your unique needs.

All of Pro, plus:

- Unlimited number of virtual and physical cards

- Cards available in GBP, EUR, and USD

- Configurable roles for users – external bookkeepers, managers, admins, and others

- Customisable non-nominative cards for company expenses, projects and teams

- Advanced reporting with filters by user, currency, period, and more

Soldo Custom – If you have a large organisation, you can contact sales to discuss enhanced options.

You will enjoy every feature from Premium, plus:

- Custom onboarding and product training

- Enhanced integration with your systems (API)

- A dedicated Customer Success Manager

- Early access to new features and the option to join Soldo’s customer feedback panel

Are There Limits or Other Fees in Soldo?

Yes.

Limits include:

Maximum purchase value per card per single transaction (€100k); Maximum purchase value per card per day (€100k); Maximum purchase value per card per month (€40k); Cashpoint withdrawal limit per plastic card per transaction (€250); Cashpoint withdrawal limit per plastic card per day (€750); Cashpoint withdrawal limit per plastic card per calendar month (€3k).

Other fees include:

A one-off fee for each card (£1 for a virtual card, £5 for a physical one); ATM withdrawal fees (£1 each if in the UK, £2 if overseas); currency exchange fees (1% of the transaction amount); card balance enquiry (£0.50 at cashpoint, £0.10 by SMS); bank transfer fees if not in the UK (£6 for SEPA money transfers in Europe, £16 for international transfers); transaction investigation fee (€10)

You can discover all Soldo fees here.

What’s Included With All Soldo Plans?

All Soldo Plans include:

Soldo Mastercard cards – you can get virtual cards for online purchases or contactless physical cards for any payments. Millions of merchants around the globe accept Soldo cards.

Free and instant transfers to employee cards – there are no fees for adding funds to your Soldo account or making domestic transactions. Foreign exchange fees are just 1 per cent for Premium, Pro and Custom plans, and 2 per cent for Uno.

Basic reporting and accounting integration – you can export data to all the popular accounting software with a few clicks. Easy-to-use integrations enable you to send expenses to QuickBooks Online and Xero.

Soldo app and web console – you can manage cards, view balances and capture receipts on the employee app, or automate admin and see spending on the web console in real-time.

Dedicated customer support – Soldo’s friendly customer success team provide round-the-clock support.

What’s the Right Plan for My Business?

From big corporates to sole traders (and everything in between), Soldo has a plan that’s perfect for you.

Uno is perfect if you’re a small business in the early stages of improving your expense management processes; Pro offers excellent value if you’re a small and growing team; Premium makes it easy to manage corporate-level expenses thanks to advanced reporting and permissions.

Leaving Soldo | Soldo Review

If, for any reason, you want to leave Soldo, the process is easy.

Soldo allows you to close your account at any time and transfers the funds available on your account back to the account from which they were initially deposited.

Soldo Customer Support | Soldo Review

Soldo offers support via live chat and email if you have any queries about the company’s operations, future developments, or your account. This service is available from Monday to Saturday from 9 am to 6 pm.

Alternatively, you can visit the FAQ sections at support.soldo.com for useful links and detailed explanations on different account-specific topics. You may find all you need there without having to contact a customer care representative.

Who Are Soldo’s Competitors? | Soldo Review

Soldo’s competitors include Pleo, Expend and Equals Business Expense Card.

Soldo Pro’s £5 per month fee compares favourably against competitors offering related customer spending solutions, with Pleo’s Essential plan setting each user back £6 per month and Expend’s Business account costing £6.99 per user every month.

Soldo Review Verdict: Should I Use Soldo? | Soldo Review

Although there are a few niggles, generally, the pros far outweigh the cons.

Soldo was created to complement the conventional business account offering with innovative, more advanced financial services.

Soldo combines smart prepaid company cards with a complete management platform to provide a seamless way to manage spending.

It’s probably a good investment if you have multiple employees who often travel for business, organise events or host dinners.

If you’re the one doing most of the spending or have trusted staff members to cover that part of your job, Soldo won’t be necessary. A regular business account will probably do just fine.

Recent Comments