Table of Contents

Introduction

In the dynamic world of finance, technology has been a game-changer. Enter fintechs: financial technology companies that are harnessing the power of tech to innovate and streamline financial services. From mobile payments to cryptocurrency, fintechs are redefining how we interact with money. But as these digital financial transactions become more prevalent, so does the specter of fraud. The need for robust fraud detection and prevention systems has never been more critical.

Detecting and preventing fraudulent activities in this fast-paced digital landscape is a complex and daunting task. Traditional methods often fall short in the face of sophisticated schemes that exploit the anonymity and speed of online transactions. The recent security breaches at large corporations, which resulted in millions of dollars lost and compromised personal data, underscore the urgency of this issue.

This is where Artificial Intelligence (AI) steps in. AI, with its ability to learn from patterns and make predictions, offers a potent solution to the challenges of fraud detection. It can sift through massive amounts of data at lightning speed, spotting anomalies that might elude human analysts or conventional systems.

Imagine a system that not only identifies a suspicious transaction but also learns from it to better anticipate and prevent future attempts at fraud. This is the promise of AI-based fraud detection tools, a promise that could revolutionize security measures in the fintech industry.

In this article, we will delve into the transformative potential of AI in fraud detection through machine learning and anomaly detection. We’ll explore how these can enhance security, protect customers, and ultimately foster trust in fintech solutions. In an era where digital transactions are the norm, AI may well be the key to safeguarding our financial future.

Machine Learning

Machine learning, a crucial subset of artificial intelligence (AI), is centered around the development of statistical models and algorithms. These allow computers to complete tasks without explicit programming, primarily by identifying patterns and making inferences for predictions or decision-making.

In the sphere of fraud detection, machine learning plays an instrumental role. It trains models to discern patterns and anomalies that could potentially signify fraudulent activities. This innovative use of AI technology not only streamlines processes but also significantly enhances security measures.

Here are some machine learning algorithms commonly used in this domain, along with real-world examples:

Logistic Regression:

This algorithm is particularly useful for binary classification problems, like determining whether a transaction is fraudulent (1) or not (0). For instance, PayPal uses logistic regression to detect fraudulent payment transfers. It analyzes various features like transaction amount, location, device information, and more to predict potential fraud.

Decision Trees:

Decision tree algorithms create a model that predicts the class of an instance by learning simple decision rules from the data features. A credit card company, for instance, might use decision trees to analyze the spending behavior, location, timing, and other attributes of transactions to distinguish legitimate ones from potential frauds.

Random Forests:

A Random Forest is an ensemble learning method that operates by constructing multiple decision trees at training time and outputting the class which is the mode of the classifications of individual trees. Companies like WorldPay use Random Forests for fraud detection due to their ability to effectively handle large datasets with numerous variables and reduce overfitting, which can be a problem with decision trees.

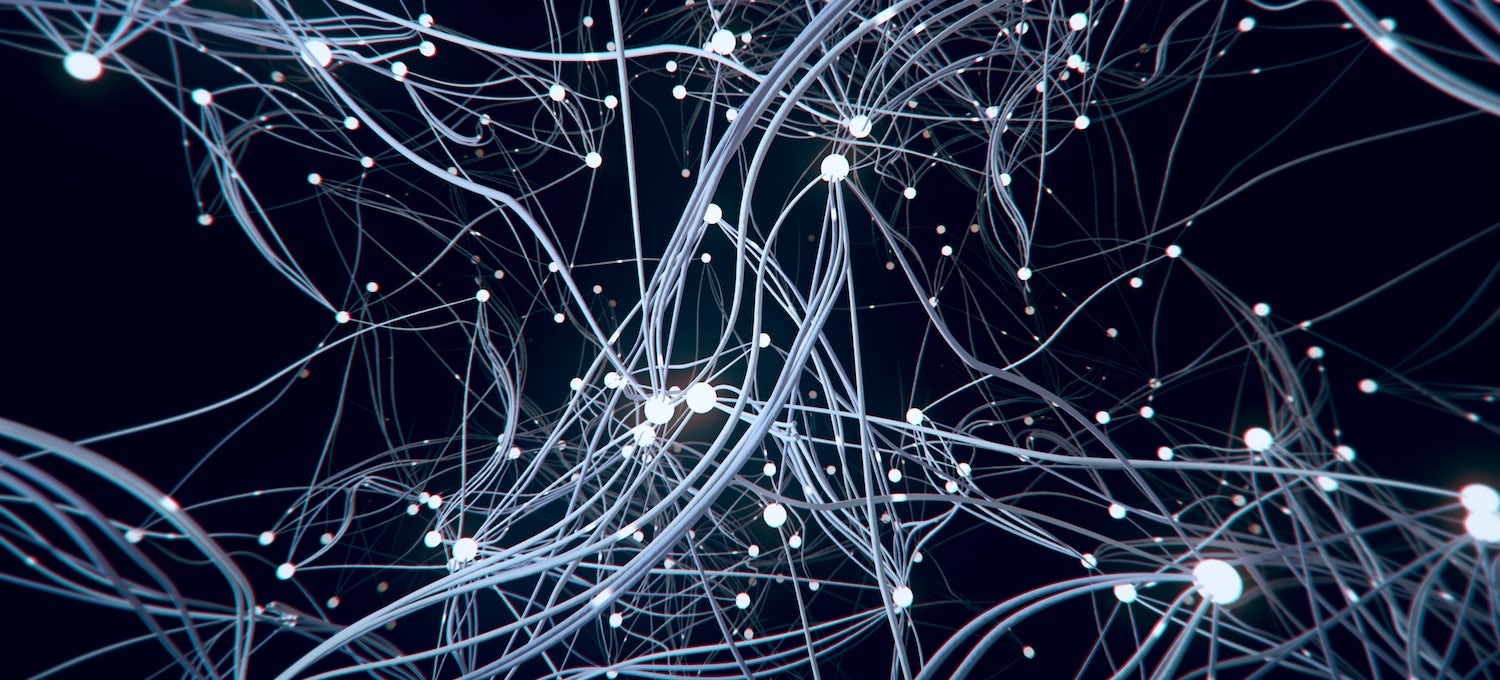

Neural Networks:

These deep learning models are excellent at recognizing patterns in unstructured data. Mastercard, for example, uses neural networks to analyze transactions. The model looks at each transaction in the context of an account’s transaction history and flags those that don’t fit the established pattern.

K-Nearest Neighbors (KNN):

KNN can be used for anomaly detection, which is crucial in identifying suspicious activities. For example, a bank might use KNN to monitor account activity. If a new transaction doesn’t align with the patterns of previous transactions (i.e., it’s not ‘near’ them in the dataset), the system might flag it as potential fraud.

In summary, these machine learning algorithms help in detecting complex patterns and anomalies that might indicate fraudulent activities, thereby playing a crucial role in safeguarding fintech operations.

Anomaly Detection

Anomaly detection is a critical aspect of fintech operations, used to identify outliers or unusual patterns that deviate from what’s considered normal. This technique is particularly valuable in identifying fraudulent activities, which often involve transactions or behaviors that are out of the ordinary.

Here are some real-world examples of how anomaly detection is being employed in the fintech industry:

Credit Card Transactions:

Credit card companies like MasterCard and Visa use anomaly detection to safeguard against fraud. They continuously monitor transaction data in real-time, flagging any activity that appears unusual based on the customer’s spending habits. For instance, an unusually large purchase or a transaction from a new location could trigger the system. This proactive approach helps prevent credit card fraud, protecting both the company and its customers.

Digital Banking:

Banks like HSBC and Barclays use anomaly detection to monitor digital banking activities. Any unusual login activity, such as accessing online banking from a new device or at odd hours, can be flagged for further investigation. This helps prevent cybercrimes like identity theft and account hacking.

Insurance Claims:

Insurance companies like Lemonade use AI-powered anomaly detection to scrutinize insurance claims. If a claim deviates from the norm based on factors like claim amount, claim history, and type of damage, it may be flagged as potentially fraudulent.

Trading Platforms:

Trading platforms like eToro employ anomaly detection to identify unusual trading patterns that could indicate market manipulation or insider trading. By monitoring trading data in real-time, these platforms can quickly detect and respond to potentially illegal activities.

P2P Payments:

Peer-to-peer payment apps like Venmo and Cash App use anomaly detection to track user behavior and transaction patterns. If a user suddenly starts making frequent high-value transactions, the system would flag it as anomalous behavior, potentially indicating money laundering or other illicit activities.

These examples underscore the value of anomaly detection in maintaining the integrity of fintech services. It not only helps protect businesses and their customers from fraud but also enhances trust in digital financial systems. As technology continues to evolve, we can expect even more sophisticated anomaly detection methods to emerge, further bolstering security in the fintech sector.

Conclusion

Artificial Intelligence (AI) and Machine Learning (ML) have considerably transformed fraud detection in the fintech industry. They analyze vast data, identify patterns, and aid in real-time monitoring and proactive fraud prevention. Real-world applications of these technologies have been transformative with companies like Mastercard leveraging AI to prevent fraud and enhance customer services. The integration of machine learning with other innovative techniques has optimized the detection of fraudulent transactions across sectors. The future promises continued innovation and development of AI and ML technologies, delivering even more secure, efficient, and customer-focused services. The potential integration of AI and ML with emerging technologies like blockchain presents exciting possibilities for creating even more secure systems. As these technologies evolve, we can expect a safer and more efficient financial landscape.

Recent Comments