Table of Contents

What is Qonto Bank?

Qonto is an expert on-line bank that is presently being spoken about a whole lot, specifically as a result of its relatively remarkable development given that its production in 2016, greater than 40,000 firms have actually started to utilize its solutions.

Providing both bank accounts for business owners as well as an on the internet social funding down payment solution, we wondered sufficient to confirm for ourselves the factors for such a success for Qonto, particularly given that the competitors are today he is surging in the expert electronic banking particular niche.

For this, we are most likely to divide customarily the different deals of the Qonto financial institution, in order to enable you to create your very own point of view on the toughness and also weak points of this electronic banking for specialists which gets on the surge.

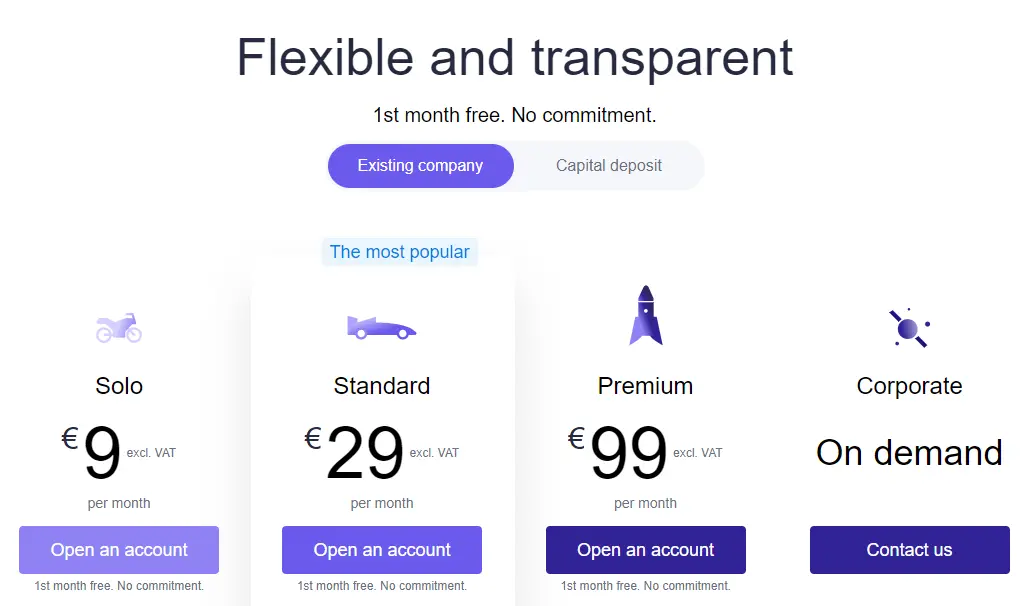

Qonto Pricing

It goes from EUR 9 per month in the Solo plan up to EUR 99 in the Premium Plan. Check them here.

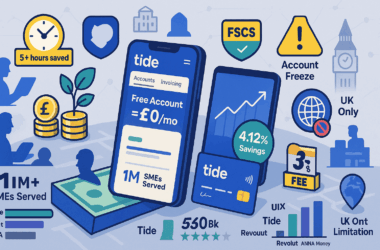

Pros and Cons for Qonto Bank

Pros

✓ Very competitive and transparent rates vs traditional bank

✓ Qualitative and responsive customer service (7/7)

✓ Very well-rated mobile app

✓ Very positive customer feedback

✓ Varied offers (bank accounts and cards)

✓ Numerous services (accounting, capital deposit. ..)

✓ Compatible with many legal structures

✓ Several Payment Methods

✓ Well Done Bookkeeping

✓ Teams access. Unlimited members on the Premium plan

✓ Automated Finance Management

Cons

✓ No offers for associations

✓ A limited number of Solo formula transfers

What they’re current Offer?

✓ Free 30-day trial ❤️

✓ No obligation

✓ Sponsorship of 10 €

Recent Comments