Table of Contents

The $3B NBO Opportunity

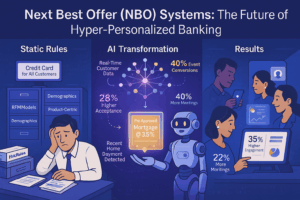

Banks that implement AI-driven Next Best Offer (NBO) systems see 18–35% higher acceptance rates on recommendations (McKinsey, 2024).

Yet, 74% of banks still rely on manual rules like “Offer a credit card to customers with $5K+ deposits”—missing real-time signals like browsing behavior or life events.

This article breaks down how leaders like Morgan Stanley and HSBC use NBO engines to deliver the right product, at the right time, through the right channel—with a 5-step implementation guide.

1. How NBO Systems Work: 3 Core Techniques

Technique 1: Reinforcement Learning (RL)

What it does: Continuously tests and optimizes offers based on customer responses.

Example: JPMorgan’s “Capital One Offers”:

- RL models adjust credit limit increase offers in real time.

- If a customer ignores email offers but accepts app notifications, the system shifts channels.

Result: 28% higher uptake vs. static rules (JPMorgan Chase, 2023).

Reinforcement learning is ideal for NBOs because it thrives in dynamic environments. However, it requires clean historical data on past offer performance. Many banks fail by skipping this data-audit step—leading to models that ‘reinforce’ bad habits.

Technique 2: Graph Analytics for Contextual Offers

What it does: Maps relationships between customers, products, and external data (e.g., social networks).

Example: HSBC’s “Life Event Engine”:

- Detects weddings, home purchases, or job changes via:

- Transaction spikes (e.g., sudden large deposits = bonus payout).

- LinkedIn API integrations (with consent).

- Triggers tailored offers (e.g., mortgage pre-approval after home down payment).

Result: 40% higher conversion on life-event offers (HSBC, 2024).

Graph analytics is powerful but risky. HSBC’s LinkedIn integration required explicit opt-ins to avoid GDPR violations. Always start with internal transaction data—it’s safer and still highly predictive.

Technique 3: Generative AI for Personalization

What it does: LLMs craft hyper-personalized offer messaging.

Example: Morgan Stanley’s GPT-4 Integration:

- AI generates custom email/text copy for advisors’ clients:

- “John, based on your recent Tesla stock trades, consider our EV-sector portfolio…”

- Human advisors review before sending.

Result: 2x faster advisor workflow + 22% more meetings booked (Morgan Stanley, 2024).

Generative AI’s real value isn’t replacing humans but augmenting them. Morgan Stanley’s ‘human in the loop’ approach avoids regulatory pitfalls while scaling personalization.

2. Implementation Roadmap (With Pitfalls to Avoid)

Step 1: Data Consolidation

Goal: Unify transaction history, CRM, and digital engagement data.

Banks with centralized data see 4x faster NBO deployment (Gartner, 2024).

Pitfall: Siloed data leads to offers like “Get a mortgage!” to customers who just signed one.

Start with a ‘single customer view’—even if it’s just 3 data sources (e.g., core banking, email clicks, call logs). Perfect is the enemy of good.

Step 2: Pilot Use Case Selection

Best starter options:

- Credit card limit increases: Low-risk, high-ROI.

- Savings account upsells: Easy to track via deposit spikes.

Avoid: Complex products (e.g., wealth management) until Phase 2.

One European bank failed by starting with investment offers—their compliance team demanded 6-month model reviews. Credit cards took 3 weeks to approve.

Step 3: Tech Stack

| Tool Type | Options | Cost (Annual) |

|---|---|---|

| Low-Code (Biz Teams) | Dataiku, Pegasystems | $50K–$200K |

| Cloud ML (Data Sci) | AWS SageMaker, Databricks | $100K–$500K |

Low-code platforms cut initial build time by 50%, but may limit advanced RL. Weigh speed vs. flexibility based on team skills.

3. The Future: Autonomous NBOs

- Trend: Fully automated offer systems (e.g., Klarna’s “instant loan pre-approvals” at checkout).

- Challenge: Regulatory scrutiny—the EU’s AI Act requires explainability for all financial AI.

Autonomous NBOs are coming, but banks must document why an offer was made (e.g., ‘30% likelihood of acceptance based on 5 transaction patterns’). Start building audit trails now.

Conclusion: Your NBO Game Plan

- Prioritize data unification—even a basic customer view beats silos.

- Start with RL-driven credit cards—fast ROI, lower risk.

- Use GenAI for messaging—but keep humans reviewing.

Recent Comments