Classic savings accounts pay 1 to 2% a year on average.

With inflation of 8 to 9% a year, you’re losing money AS WE SPEAK.

So, we prepared this guide to show you how to beat inflation and save your precious money, let’s go!

Table of Contents

1st Step | Registration in a High-Interest Platform

First, you need to choose a High-Interested platform.

There are a few in the market like Blockfi, Crypto.com, Binance, Hodlnaut, Abra, etc.

We recommend Nexo.

Some reasons:

- Nexo is fully regulated in several countries and even at US states level;

- They’re audited in Real-Time via Armanino/TrustExplorer;

- The assets are backed up to $375,000,000 insurance with BitGo, Ledger Vault and Bakkt. All well-respected players;

- Friendly, intuitive and easy-to-use interface;

- Transparency on reports.

Anyways, feel free to do your own due diligence. 😉

Here is the step-by-step for the registration on Nexo:

1 – Go to Nexo.

2 – Click on “Create Account“:

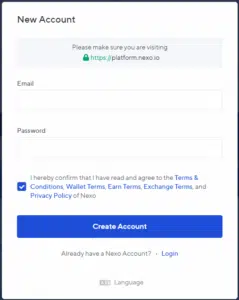

3 – You will be redirected to https://platform.nexo.io/new

4 – Enter your email and choose a strong password, then click the ‘Create Account’ button:

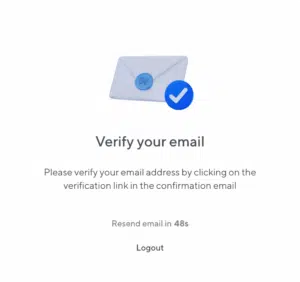

5 – After clicking on the ‘Create Account’ button, you will be asked to verify your email address by clicking on the link in an email which was sent to the email address you used upon registering your Nexo account:

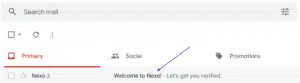

6 – Go to your personal email account:

7 – Open the email from Nexo and click ‘Verify Email’:

8. Your email with be verified and after you click on “Continue to your Nexo Account” you will be redirected to the Nexo platform:

2nd Step | Top Up your Starting Capital

Your earnings will be a consequence of the amount you top up on your account.

For example: technically if you top up $100,000 in 1 year you’ll have $117,346.97 considering compound interest with 16% a year.

Nexo accepts US Dollars, Euros and Pounds.

The example below is with Pounds but the logic applies to all currencies.

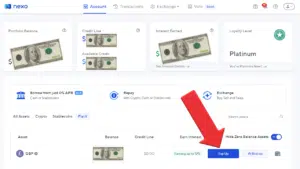

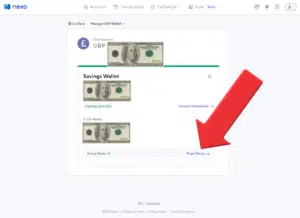

1 – Open your Nexo account and scroll down to the GBP wallet.

2 – Click on the Top Up button:

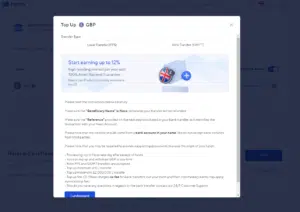

3 – Select your preferred transfer method:

HINT: We recommend “Local Transfer (FPS)“, much faster.

4 – Once you click on the “I understand” button, the respective banking details will be presented to you. Next, you have to initiate a bank transfer to those banking details. Please, do not forget to include your personal reference code to ensure prompt and successful completion of your transfer:

5 – DONE!

3rd (and final) Step | Allocate your money in the correct place

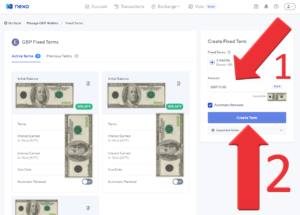

Now that your money is on the account it’s time to create a “Fixed Term“.

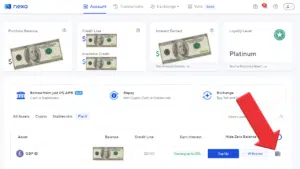

1 – On the same screen you used to top up now click on the “Manage Wallet” icon on the right-hand side:

2 – Click on ‘Fixed Terms‘:

3 – Enter the desired amount and click on ‘Create Term‘ to complete the process:

4 – DONE!

Now it’s time to relax and see your wealth growing. 🙂

A few things to have in mind:

- The “Fixed Terms” have a minimum of 3 months. You cannot redeem the amount before this period.

- You’ll be paid daily. Follow up the payments via “Notifications” on the top of the main screen/dashboard. Following the earlier example, with $100,000 on “Fixed Terms“, you’ll receive $44 a day. Not bad!

- Be sure you turn ON the option ‘Earn in Kind‘, which means you’ll be paid in the same currency you deposit. Otherwise, you’ll be paid in Nexo tokes.

- It’s recommended to always reinvest the amount obtained with the ‘Fixed Term‘ as you take the best of the compound interest. Worst case scenario, when your ‘Fixed Term‘ finishes the earned amount will be in your ‘FLEX Terms‘ which still have a 7% a Year. Not bad.

In a nutshell, we definitely recommend this method due to its consistency and safety.

Feel free to share this system with anyone who you think would love it! See ya!

Recent Comments