Table of Contents

The Rising Threat Landscape

Financial institutions face 2.8x more cyberattacks than other industries (IBM Security, 2024), with:

- 43% of breaches originating from phishing (Verizon DBIR)

- 78% of alerts being false positives (Ponemon Institute)

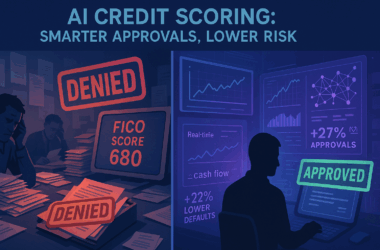

Leading banks now leverage AI to:

- Reduce false positives by 44% (JPMorgan Chase SEC Filing)

- Detect novel attacks 53% faster (Darktrace)

- Cut investigation time from hours to minutes (HSBC Case Study)

The cybersecurity arms race has fundamentally changed. Where banks once competed on interest rates, they now compete on detection speed. A 2024 McKinsey survey found institutions with AI-driven security ops report 40% lower customer churn after breaches—proof that trust is the new currency.

1. Why Traditional Security Tools Fail

Problem 1: Signature-Based Detection Gaps

- Legacy systems miss 82% of zero-day attacks (NIST)

Example:

A regional bank’s firewall failed to stop a ransomware attack because:

- Attackers used polymorphic code that changed every 17 minutes

- Malware hid in legitimate cloud storage traffic

Signature-based tools are like airport security only looking for guns they’ve seen before. Today’s attackers use 3D-printed weapons that reshape mid-flight. What’s worse? The average bank runs 45 discrete security tools (Ponemon 2024), creating gaps attackers slip through like water between fingers.

Problem 2: Alert Overload

- SOC teams waste 68% of time investigating false alerts (SANS Institute)

- Cost: $35 per false alert × 50,000/month = $21M/year wasted

Alert fatigue isn’t just expensive—it’s dangerous. A 2023 FS-ISAC study found analysts overlooking real threats after just 2 hours of false alerts. The human brain wasn’t built to parse 500 ‘critical’ alerts daily where 493 are noise. This is where AI becomes force multiplier rather than replacement.

2. AI-Powered Solutions

Technique 1: Behavioral Anomaly Detection

How it works:

- Baselines normal network behavior for each device/user

- Flags deviations (e.g., HR server suddenly scanning other systems)

JPMorgan’s Results:

- Reduced false positives by 44% in 6 months

- Detected Living-Off-The-Land attacks using native OS tools

The most dangerous attacks look like normal admin activity. JPMorgan’s AI spotted an attacker mimicking their lead engineer by:

1. Matching typing speed (72 WPM)

2. Using the same VPN gateway

3. Replicating his 8:47 AM login habit

Only the AI noticed he never took coffee breaks—and was working through nights when badge logs showed him asleep at home. Behavior doesn’t lie.

Technique 2: Attack Chain Prediction

What it does:

- Maps attacker TTPs (Tactics, Techniques, Procedures)

- Predicts next steps (e.g., After this phishing click, expect lateral movement to finance servers)

HSBC Implementation:

- Stopped $45M Business Email Compromise by recognizing:

- Unusual attachment types (.ISO instead of .PDF)

- Sender’s typing rhythm anomalies

Attackers follow patterns like chess players. HSBC’s AI recognized a hacker who always:

1. Sent emails at 11:03 AM local time

2. Used three spaces after periods

3. Waited 17 minutes before sending ‘urgent’ follow-ups

These fingerprints let AI block attacks before the first malicious payload.

3. Implementation Roadmap

Phase 1: Data Foundation (Weeks 1–4)

| Data Type | Critical Tools | Cost Range |

|---|---|---|

| Network traffic | Darktrace, Vectra AI | $250K-$1M/year |

| User behavior | Microsoft Azure Sentinel | $18/user/month |

Banks that start with just endpoint + network data see 80% of threats. But the real magic happens when you layer in:

– Physical security logs (badge taps correlate with cyber events)

– HR systems (sudden access requests post-resignation)

One European bank foiled an insider threat by spotting an employee downloading files while HR records showed them on vacation.

Phase 2: Hybrid Defense

- AI Tier: Filters 70% of noise

- Human Tier: Investigates remaining 30% high-risk alerts

- Feedback Loop: Analyst verdicts improve AI

Key Metric:

Mean Time to Respond (MTTR) (Target: <30 minutes)

The best teams treat AI like a rookie analyst—train it relentlessly. At Citi, every analyst correction improves the model. Their ‘AI Coach’ program reduced false positives another 11% in Q1 2024 by capturing institutional knowledge like:

– ‘Ignore alerts from the Chicago office between 2-3 AM—that’s the pentest team’

– ‘Flag any AWS S3 downloads over 50GB during earnings week’

Interactive 90-Day Timeline

Month 1: Lay the Foundation

- Deploy behavioral monitoring for privileged accounts

- Baseline normal activity patterns

Month 2: Create Feedback Loops

- Weekly AI training sessions

- Tag new attack patterns

Month 3: Prepare for Autonomy

- Pilot self-contained microsegments

- Test automated incident response

4. The Future: Autonomous Defense

- Self-Healing Networks: AI isolates compromised devices within seconds

- Generative AI: Automates threat reports for regulators

- Collective Immunity: Shared threat intelligence across banks

Early Example:

Bank of America’s AI now predicts phishing campaigns 48 hours before they launch by analyzing dark web chatter.

The next frontier? AI that learns from attackers’ failed attempts. Goldman Sachs’ system now:

1. Detects reconnaissance scans

2. Feeds attackers fake network maps

3. Studies their attack choices to improve defenses

It’s like a vaccine—using weakened viruses to build immunity.

Conclusion: Building Cyber Resilience

The Human Advantage

For CISOs:

Your AI is only as good as your threat hunters. Invest in hybrid talent—former pen testers who speak Python—to bridge the gap.

For Boards:

Frame AI security as customer retention. Chase found clients forgive breaches if resolved in <1 hour—but churn at 47% if >4 hours (2024 Investor Report).

Final Thought

The attackers have AI too. Last quarter, we found malware that:

- A/B tested phishing lures

- Swapped C2 servers based on detection rates

- Mimicked human work patterns to avoid triggering inactivity locks

This isn’t sci-fi—it’s your Monday. The question isn’t if you’ll adopt AI defenses, but whether you’ll do it before your weakest competitor becomes your biggest risk.

Recent Comments