The fintech revolution is not just about digitizing financial services; it’s about transforming them through personalization. Artificial intelligence (AI) plays a pivotal role in this transformation, enabling fintech companies to offer tailored financial advice and product recommendations that resonate with individual customers. This surge in AI-driven personalization has also led to a boom in fintech jobs, attracting talent from various sectors eager to be part of this innovative wave.

So let`s take a roundup of AI driven personalisation and see how it is changing the way we experience world.

Table of Contents

The Role of AI in Personalization

Data Analysis and Pattern Recognition

AI algorithms excel at processing vast amounts of data from multiple sources, transaction histories, social media activity, geolocation data, and more. By identifying patterns and correlations within this data, fintech companies can gain deep insights into individual customer behaviors and preferences.

Square, the mobile payment company, uses AI to analyze transaction data from small businesses. This analysis helps merchants understand customer spending habits, enabling them to offer personalized promotions and improve customer retention.

Machine Learning Algorithms

Machine learning (ML) enables fintech platforms to predict future customer behavior and personalize services accordingly. Supervised learning models can forecast credit risk or investment performance, while unsupervised learning helps in customer segmentation.

Affirm, a fintech company offering installment loans at the point of sale, employs ML to assess creditworthiness instantly. This allows them to provide personalized loan terms to customers during checkout, enhancing the shopping experience.

Natural Language Processing (NLP)

NLP allows AI systems to comprehend and generate human language, facilitating more natural interactions between customers and fintech services.

Kabbage, a small business lending platform, uses NLP to analyze customer interactions and financial documents. This speeds up the loan approval process and offers personalized loan options, creating new fintech jobs in AI development and data science. Kabbage performed so well that it got acquired by American Express and its proprietary platform was renamed Blue Print by American Express.

Personalized Financial Advice

Robo-Advisors

Robo-advisors have democratized investment management by providing algorithm-driven financial planning with minimal human intervention.

Personal Capital combines robo-advisory services with human financial advisors. Their AI algorithms offer personalized investment strategies, while human advisors are available for more complex financial planning, opening up fintech jobs for hybrid roles that blend technology and personal finance expertise.

AI-Driven Investment Strategies

Advanced AI systems analyze market data, news sentiment, and even social media trends to optimize investment portfolios.

BlackRock’s AI platform, Aladdin, assesses risk and portfolio management for clients by processing billions of data points daily. This sophisticated tool requires a skilled workforce, creating numerous fintech jobs in AI research and development.

Risk Profiling and Portfolio Management

AI enhances risk assessment by incorporating non-traditional data sources, leading to more accurate risk profiles and personalized investment advice.

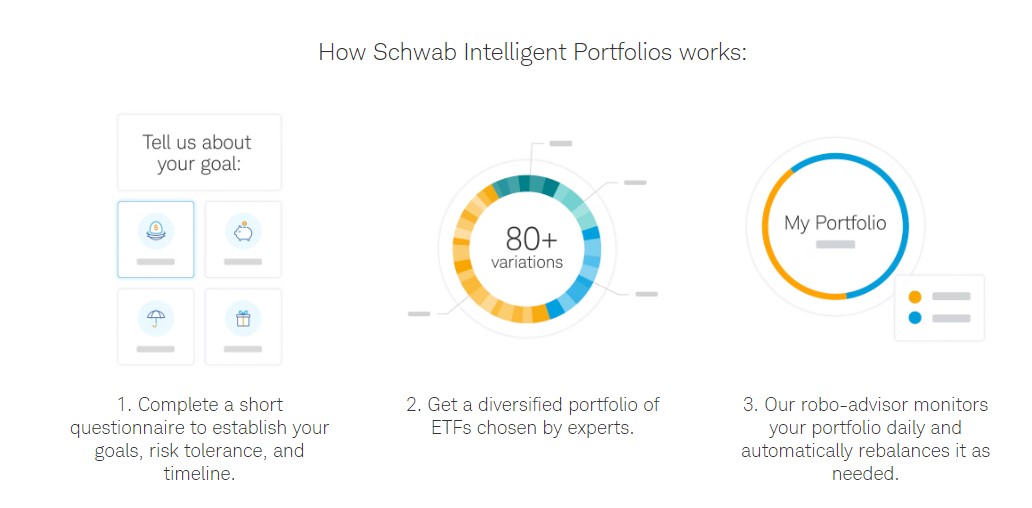

Photo credit: Charles Schwab

Charles Schwab’s Intelligent Portfolios use AI to automatically rebalance and tax-loss harvest, providing clients with a personalized investment experience while employing professionals in new fintech jobs centered around AI and data analytics.

Personalized Product Recommendations

Credit Scoring and Lending

AI-driven credit scoring models consider alternative data, making credit accessible to a broader audience.

Petal uses AI to analyze banking history rather than credit scores to approve credit card applications. This approach personalizes lending and opens credit access to those with limited credit history, also generating fintech jobs in AI algorithm development.

Personalized Banking Products

Banks leverage AI to offer products that match individual financial behaviors and goals.

Revolut, a digital banking app, uses AI to provide personalized budgeting tools, spending analytics, and even investment opportunities in cryptocurrencies and stocks, fostering a range of fintech jobs in AI, cybersecurity, and compliance.

Insurance Underwriting and Policy Customization

AI enables insurers to tailor policies based on individual risk profiles.

Root Insurance uses AI to assess driving behavior via a mobile app, offering personalized auto insurance rates. This innovation not only benefits consumers but also creates specialized fintech jobs in AI data analysis and mobile app development.

AI Technologies Enabling Personalization

Big Data Analytics

The ability to process and analyze big data is crucial for personalization.

Mastercard employs big data analytics to detect fraud in real-time and offer personalized rewards programs, leading to the creation of numerous fintech jobs in data science and analytics.

Machine Learning and Deep Learning

Deep learning models help in complex pattern recognition, essential for personalization.

HSBC uses deep learning to analyze transaction patterns and detect money laundering activities. This not only secures the financial system but also opens up fintech jobs in AI ethics and compliance.

Predictive Analytics

Predictive analytics forecast customer needs, allowing proactive service offerings.

Capital One uses predictive analytics to anticipate customer needs, such as predicting when a customer might need a credit line increase, thereby enhancing customer satisfaction and creating fintech jobs in predictive modeling.

Chatbots and Virtual Assistants

AI-powered chatbots provide instant, personalized customer service.

Kasisto’s AI assistant, KAI, is used by banks like DBS Bank to offer customers personalized financial advice through conversational banking, leading to new fintech jobs in generative and conversational AI development.

Benefits to Consumers and Fintech Companies

Enhanced Customer Experience

Personalization leads to services that closely align with customer needs.

Mint, a personal finance app, uses AI to provide personalized budgeting tips and alerts, improving user engagement and financial health.

Increased Customer Engagement and Retention

Tailored experiences encourage loyalty.

Starling Bank offers personalized insights into spending habits and saving goals, resulting in high customer retention rates and contributing to the growth of fintech jobs in customer experience management.

Operational Efficiency and Cost Savings

Automation reduces costs and improves efficiency.

JP Morgan’s COIN program uses AI to review legal documents and contracts, saving thousands of hours of manual work and creating fintech jobs in AI system maintenance and legal tech.

Challenges and Ethical Considerations

Data Privacy and Security

Collecting personal data necessitates stringent security measures.

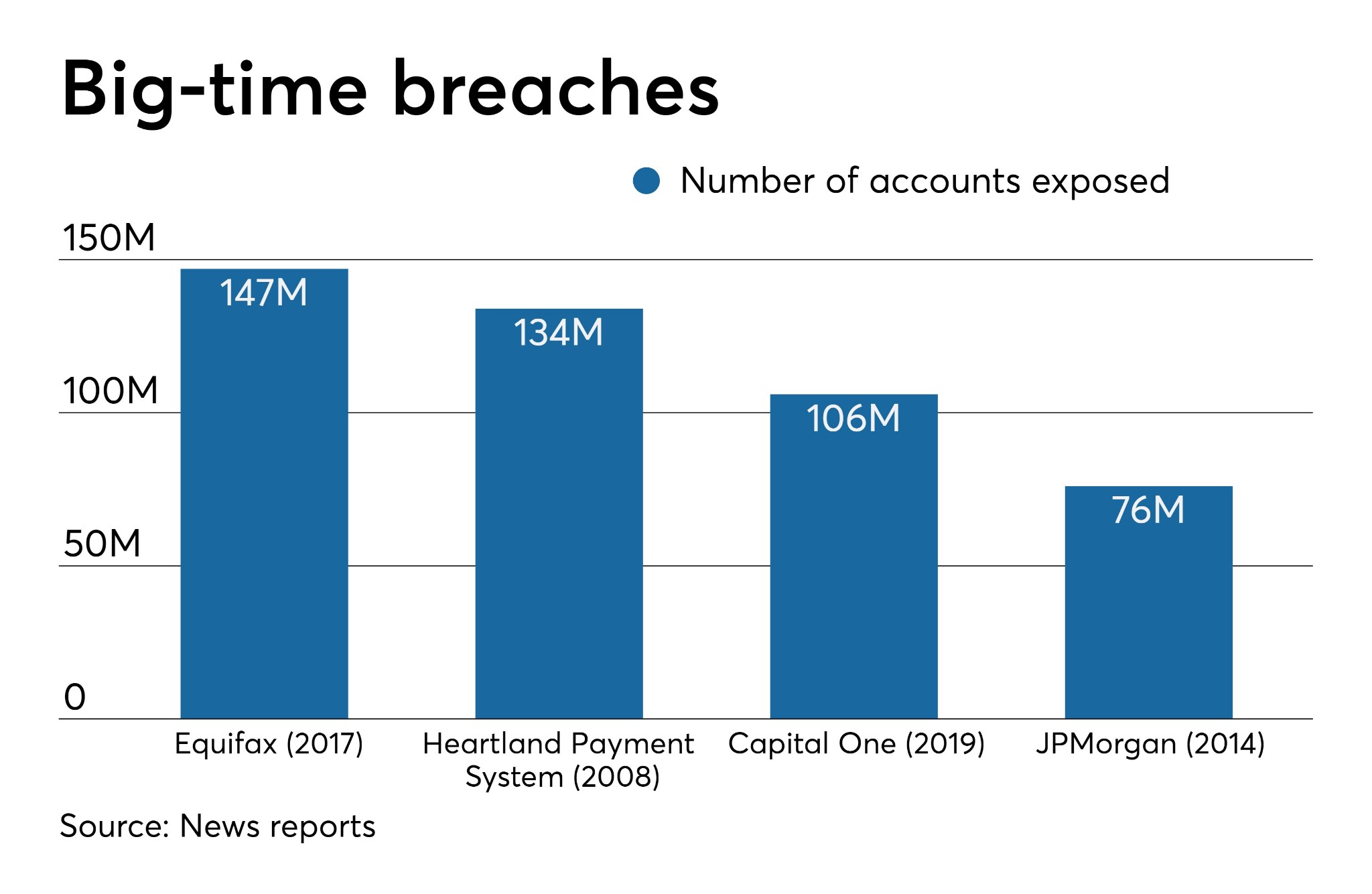

Photo Credit: American Banker

The 2019 Capital One data breach, where almost 106 million customers across US and Canada, had their personal data stolen, highlighted the importance of cybersecurity, emphasizing the need for fintech jobs in data protection and ethical hacking.

Algorithmic Bias

AI systems must be monitored to prevent bias.

Concerns arose when Apple Card’s AI was found to offer different credit limits based on gender. It was found to have a bias towards men, giving them higher credit limits then women. This incident underscored the importance of fairness in AI, leading to fintech jobs in AI ethics and compliance.

Regulatory Compliance

Navigating the legal landscape is complex.

GDPR compliance requires fintech companies to handle data carefully, creating fintech jobs in legal compliance and data governance.

Future Trends

Advancements in AI Technologies

Emerging technologies like explainable AI (XAI) will make AI decisions more transparent.

Banks adopting XAI can better explain credit decisions to customers, improving trust and opening up fintech jobs in AI transparency and user education.

Integration of AI with Other Technologies

Combining AI with blockchain and IoT will further personalize financial services.

IBM is working on integrating AI with blockchain to enhance transaction security and personalization, creating interdisciplinary fintech jobs at the intersection of these technologies.

Personalization Beyond Finance

AI-driven personalization is extending into other industries, influencing fintech.

Tesla’s entry into insurance uses driving data to offer personalized rates, blurring the lines between automotive and financial services and creating unique fintech jobs that require cross-industry expertise.

Conclusion

AI-driven personalization is reshaping the financial landscape, offering immense benefits to consumers and fintech companies alike. As the industry continues to innovate, opportunities abound for professionals interested in AI, data science, cybersecurity, and more. Embracing ethical considerations and regulatory compliance will be crucial in harnessing the full potential of AI in fintech personalization.

Recent Comments