Table of Contents

What is GoSolo? | GoSolo Review

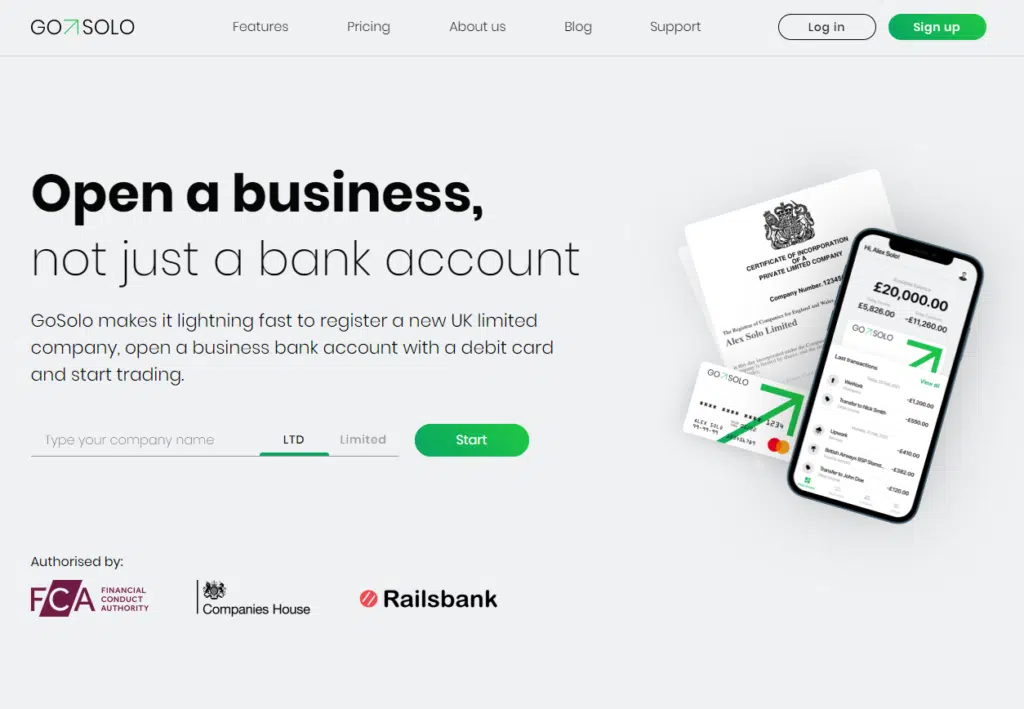

GoSolo is a new digital business toolkit and secure banking app for founders, freelancers, and consultants.

The challenger banking brand rejects the notion that starting a business has to be a complicated affair. As an Authorised Agent of the Companies House, the platform makes it easy to register a new limited company in the UK or open a business bank account for an existing one.

Their goal is to deliver a business tool that’s frictionless, intuitive and agile, leaving you more time to focus on what you do best.

GoSolo promise to be with you all the way – from planning to launching to transacting to controlling and networking your business. Their vision is to be the most comprehensive and helpful business bank account on the market.

Who Owns GoSolo?

GoSolo is a platform by entrepreneurs for entrepreneurs.

It was founded in 2019 by Dima Pimakhov to address the concerns most people have when starting and operating a business.

Everyone in the GoSolo team has extensive experience running their own business, so they know the pains, the openings and areas to focus on.

How Does GoSolo Work?

GoSolo is an institution licensed by the FCA to handle electric money, just like PayPal, Mastercard or Stripe. Their authorisation allows them to facilitate business transactions.

But GoSolo offers more than just a place for your business to hold its electronic money.

They also register your company for you, provide simple invoice templates to submit to your clients, log payments for those invoices automatically and even chase up slow payers! Their focus is on helping businesses to function with as little hassle as possible.

GoSolo is not, however, allowed to provide FSCS* deposit guarantees or loans. Neither do they handle physical money, whether in cash or cheque.

*The FSCS protects customer deposits of up to £85k if the financial institution goes bust and has to stop trading.

Share Structure

The first time you register a company via GoSolo sets the default share structure at 100 shares for the total value of £100.

Issued shares are non-redeemable and rank equally in terms of voting rights (one share=one vote), rights to participate in all approved dividend distributions, and rights to take part in any capital distribution on winding up of the company.

Eligibility

Registering your business with GoSolo is an easy process.

Just ensure you have checked the following before you start: be a UK resident above 18 years old, have a valid ID, have a valid UK business address for your company, and ensure your company does not engage in any of the restricted business activities as specified in GoSolo Terms & Conditions.

These include unregulated financial services, pyramid schemes, binary options, hawala, gambling, crypto trading, arms, sanctioned entities and businesses performing offshore bank transactions.

GoSolo Pros and Cons | GoSolo Review

Pros

- The website is straightforward and setting up an account is a breeze

- You will enjoy easy and efficient company formation and bank account opening

- There are exciting ideas to facilitate networking and matchmaking between users

- You can manage full transaction history, card status, PIN and limits through the app

- Not being tied to the label of a traditional bank means GoSolo can be more innovative and listen to their users’ needs more easily

Cons

- Putting your money in a ring-fenced account is a tad riskier than having it in an account with an FSCS-registered institution

- No direct debits

- No international money transfers

Features | GoSolo Review

To improve the business banking benchmark, GoSolo boasts features that make your entrepreneurial experience better.

You will enjoy simplified business account opening, streamlined company formation process and professional invoices that automatically match receipts.

Company Registration

Registering your company will allow you to open a business bank account and start trading under the company name. It’s free, with zero commitments or hidden costs.

GoSolo allows you to register a private limited company with a single owner/director. If you have more than one director at the firm or need to open a PLC, this service does not apply to you currently.

As part of the onboarding process, GoSolo may ask you for your valid ID and proof of address.

If everything checks out, the next step involves selecting your company’s name. To avoid rejection, ensure your name isn’t a duplicate of another company. Offensive, trademark and sensitive names are also disallowed.

Once you settle on a specific name, you can go ahead and complete a short application form. Here, you will describe the nature of your business and its projected revenue.

Once you complete your application, it will be sent over to Companies House to officially register your company. The whole process may take up to 5 working days.

Business Bank Account

Opening a business bank account is 100 per cent digital.

You need to be a UK resident to apply for a GoSolo business bank account. You can prove this by providing any of the following documents posted to you recently: tax return, bank statement, utility bill, or council bill.

Other requirements include:

- A valid ID document

- Have an active limited company registered on the Companies House database

- Be a single director and also a single owner of the company

The intelligent auto-saving feature lets you pick up where you left filling in an application without completely restarting.

Invoicing

Your customers can make instant, secure payments in three simple clicks. GoSolo generates a preview of each invoice before or after it goes to customers.

The app lets you customise templates with your company’s logo and branding.

If you need a separate VAT rate for every product item in a single invoice, the app can do that. You can decide to issue a non-VAT invoice too.

The system computes the final amounts before and after taxation, presenting them in an easy-to-read invoice layout.

Third-Party Access

The GoSolo business bank account is designed for teamwork.

By granting third-party access to statements within the app, accountants can access info when they need it. This will save you time and money. No additional software is required to do this.

For safety, apps are protected by bank-grade security algorithms.

Invited users are required to complete the full verification process. You can remove access in seconds if required.

GoSolo Plans and Fees | GoSolo Review

One of GoSolo’s major selling points is its low fees.

There are 3 plans: Launch Edition, Start and Grow.

As of this writing, GoSolo is not charging any fees, commissions or charges for using any of their services on the basic (Launch Edition) plan.

Opening a GoSolo business bank account under this plan is free for its first 500 users. You’ll also not be charged for opening a limited company, the debit card or the invoicing service.

If you upgrade to the Start plan, you’ll be required to pay £0.20 per transaction for transfers between GoSolo customers. The plan limits you to issuing only five invoices. If you want more, you have to upgrade.

There’s also a £1 ATM withdrawal charge. If you lose your card, you get a free 1 card re-issued during the first 12 months. The next card will cost you £5.

The Grow plan has a £5 monthly fee, but other than that, everything else is free of charge.

Account and Card | GoSolo Review

Payernet Limited (“PayerNet”) gives you a debit or virtual card that you can manage in the secure area of their app or site. You can activate your card, view your PIN, freeze/unfreeze and unlock it all within the GoSolo app.

How do I sign in to my GoSolo account?

You can sign in to your business bank account via the web app or mobile apps.

If you’re using the web app, head to the sign-in page on any web browser and enter your login credentials (email address and password) to be directed to the main dashboard.

You can also download the GoSolo Business Banking Mobile apps for Android or iOS and enter your login info on the ‘Sign in’ screen.

When should I expect to receive my GoSolo card?

Your card will be mailed to your selected address once your business bank account is open. You may have to wait for up to 10 working days for the card to arrive.

Can I have more than one bank account for my business in GoSolo?

As of this review, GoSolo only allows you to have one business bank account for your business.

They’re, however, planning to offer multiple business bank accounts for a single company as part of their future development.

Can I provide others with access to view my business account in GoSolo?

Yes.

Thanks to Multi-User GoSolo Account Access, you can grant permissions to other users to access your account. People with access to your GoSolo account can view your invoices history, contacts, transactions, as well as download bank account statements.

Whether it’s your accountant or employee, this can help you to improve your business operations efficiency.

Don’t worry. Once added, you can effortlessly revoke access for those individuals who no longer need it. Your account is also protected as you don’t need to share your credentials or other sensitive information.

I forgot my GoSolo password

If you can’t access your password and can’t sign in, navigate to the ‘Sign in’ page on your Web or Mobile App.

On the Web App, click on the “Forgot Password” link located below the “Password” field. On the Mobile App, click on “Forgot Password” in the top right corner.

Enter the email associated with your account and follow the provided instructions to reset your password.

You’ll be prompted to reset your password and sign in with your new password once you’re verified as the account owner.

I’ve lost my card. What next?

Activate Freeze Card status inside the app in the Cards section. Another option is cancelling your card in the GoSolo app and waiting for a replacement for up to 5 working days.

Does GoSolo has a mobile app?

GoSolo Business Banking Mobile Apps let you manage your account on the go. GoSolo Business Banking is available on Android, iOS and Web app.

Closing your GoSolo account

You can cancel your account within the first two weeks of opening it or close it at any other time with 48 hours’ notice.

Get in touch with GoSolo before exiting. You’ll need to repay any money you owe them before they can close your account. Once closed, your card won’t work and you won’t be able to access your account.

GoSolo can initiate account closure if they believe you’ve:

- Given them false information at any time

- Broken the law or attempted to break the law

- Broken the terms of the agreement

- Put them in a position where they might break the law

- Been abusive to anyone at GoSolo or a member of their community.

Payments | GoSolo Review

You must have enough cash in your account to make payments.

But some transactions may still go through, in which case GoSolo will inform you about the amount you will need to repay before the end of the day.

What’s the limit on bank account transfers in GoSolo?

The limit on making payments using online banking is £50k per transaction. Inbound payments are limited to under £50k per transaction.

Can I make international payments in GoSolo?

Yes and no.

You can use your card to make payments outside of the UK.

But if you’re using online banking, GoSolo only allows you to make payments between UK accounts.

What’s the limit on card transactions in GoSolo?

The card limit is £1,000 per transaction, £5,000 per day.

How do I deposit cash in GoSolo?

As of this writing, GoSolo doesn’t allow you to deposit cash into your GoSolo Business Banking account. But the team at GoSolo are constantly making changes, and this may change in the future.

Can payments be blocked in GoSolo?

Yes.

GoSolo may block your payments if: your instructions are not clear, they suspect criminal activity on your account, they’re not legally allowed to make the transfer, or you exceed your payment limits.

If this happens, GoSolo will let you know as soon as possible.

Do GoSolo accounts have Direct Debit?

As of this writing, Direct Debit is not part of the initial GoSolo offering

Why is the reference field when paying only limited to 18 characters?

The reason for this is the current rules and regulations set by the Faster Payments scheme.

GoSolo does this to standardise the way a payment is recorded between different UK banks.

Can I issue recurring invoices in GoSolo?

As of now, you cannot issue recurring invoices.

However, GoSolo makes raising similar invoices against the same client quick and straightforward. You can duplicate existing invoices in a few clicks.

They plan to introduce recurring invoices functionality in future versions of the GoSolo app.

Invoices | GoSolo Review

Your online invoice will be paid faster with GoSolo.

Can I create and send invoices via GoSolo?

Yes.

You do not need to figure out how the invoice looks or what information to include.

GoSolo allows you to issue and email invoices within a simple, guided 3-step process.

How can I pursue my client for payment using GoSolo?

Easy! By configuring email reminders and letting GoSolo send them automatically.

You can modify the date and frequency of reminders for due and overdue invoices.

Can I mark invoices as paid?

Yes.

After receiving a payment, you can change the invoice status by marking it as paid with a single click.

Is it possible to reconcile invoices against the payments received?

Yes.

After receiving payment on your GoSolo account, the system will check the amount and its reference.

If there’s a corresponding unpaid invoice, GoSolo will automatically pair it with the payment received.

How can I ensure that my client received and downloaded an invoice?

GoSolo sends all invoices as a webpage where your client can preview the invoice or download the document’s PDF.

Your client may also alert you about their acceptance of the payment conditions settled out in the invoice.

In the app, you can see the exact date and time when your client opened the invoice page, downloaded a PDF or accepted the invoice.

Is GoSolo Legit? | GoSolo Review

GoSolo is authorised by the FCA, Railsbank and Companies House.

They have completed all the necessary compliance checks to be authorised as an e-money agent, and have a 3.5/5 rating on Trustpilot.

Is GoSolo Safe? | GoSolo Review

Despite it not being licensed as a bank, GoSolo employs high-level security to protect your account and data. All GoSolo accounts have Two-Factor Authentication as standard.

The Mastercard network handles all transactions you run on your card. The transactions are entirely protected under the Mastercard rules.

Despite not offering the FSCS deposit protection, all of your funds are held in a safeguarded account. GoSolo put your money in a “ring-fenced” account with PayrNet Limited, a tier-one UK bank that they have partnered with.

Ring-fenced means that they don’t have access to it and can’t move or use it somewhere. You’re always in total control. Your agreement with PayrNet is listed here.

Is GoSolo Regulated? | GoSolo Review

GoSolo has been approved by the rigorous and stringent rules set by the Financial Conduct Authority (FCA) to be certified to operate as a legal, responsible and ethical financial services firm.

GoSolo Customer Support | GoSolo Review

GoSolo wants all of its users to have a smooth experience when using the platform. You can share your thoughts and ideas or vote for future functionality on the “Submit Ideas” page.

The company doesn’t have any branches, so all customer service is online. GoSolo’s support team can assist you by phone, email, chat, or WhatsApp.

If you’re using the app, you can send a support request by clicking on the “Contact Us” button. On the website, send a support request here.

After submitting your complaint, you’ll receive an acknowledgement email from GoSolo within 7 business days.

A member of their team will review your complaint and respond accordingly. This initial response may offer a resolution or open a dialogue to reach the best possible outcome.

If GoSolo cannot resolve your issue or their suggested resolution doesn’t satisfy you, you can refer your complaint to the Financial Ombudsman Service.

Who Are GoSolo’s Competitors? | GoSolo Review

While they deliver on their promises, other online business banking providers offer more or less similar features, functionality, and customer convenience as GoSolo.

Tide, Cashplus Bank, Revolut Business and Starling Bank’s business accounts are some of the closest GoSolo’s competitors.

GoSolo Review Verdict: Should I Use GoSolo? | GoSolo Review

GoSolo is a fairly new company at the growth stage, and it promises exciting new features. They have advanced tools and references to plan out your business.

The company lacks direct debit and international money transfer features, but their competitive fee structure makes them a good choice for those running or planning to run a small business. You will need to pay a £5 monthly fee to unlock their premium offering, which is reasonable.

Recent Comments