Table of Contents

Equals Money Review

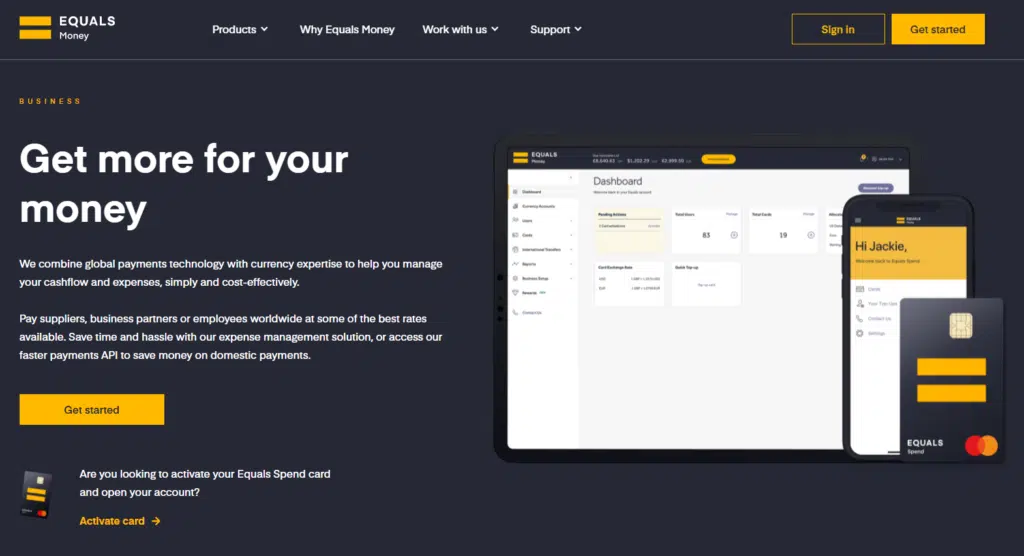

What is Equals Money? | Equals Money Review

Equals Money is a UK-based currency specialist dedicated to providing market-leading money management solutions — transfers, travel money, expense management and currency hedging.

As a subsidiary of the Equals Group, Equals Money is committed to making managing and moving money anywhere in the world as intuitive and simple as possible.

Their 280-strong team spread across London, Chester and LA are dedicated to making your experience with the company the very best it can be.

How Does Equals Money Work?

Equals Money combines global payments technology with currency expertise to help businesses effectively manage their cash flow and expenses.

The company allows you to fund your transfer over the phone or use the online platform and make international payments minus fixed fees or commission fees.

Who Owns Equals Money?

Equals Money is brought to you by Equals Group PLC, a top challenger in the financial services sector based in the UK.

The Equals Group recently expanded into the United States. The new office in Los Angeles launched its expense management solution for the US market in 2020.

Equals Money Statistics

With over 1 million global customers and 13 years in business, Equals Money has helped customers manage and move over £10 billion worldwide. Equals Money is already helping over 15,000 companies get more for their money.

Notable mentions include Toyota, Chelsea F.C., HBO, Comic Relief and Barchester Healthcare.

Equals Money Pros and Cons | Equals Money Review

Equals Money is popular with many businesses, but it has a few flaws you should also consider.

Pros

- A wider range of services than most other money transfer service providers

- Equals Money does not charge fixed fees or commission fees for sending money

- You can pay employees, business partners or suppliers worldwide at some of the best rates available

- You can make business payments in 140+ currencies

- Equals Money’s team of currency experts can guide you in making the right type of payment at the right time

- By signing up for daily market updates, you and your business will be up to speed with all things currency

- You can improve your business’s efficiency with automatic, error-free processing

Cons

- The support team is only available at certain times, from Monday-Friday 9 am to 5.30 pm

Is Equals Money Safe? | Equals Money Review

Equals Money take great care to make sure that your funds are safe and secure.

Equals Money utilizes sophisticated security techniques and encryption software to safeguard customer data and transaction details. Their system is rigorously checked.

Your data is securely stored to the highest standards under UK data protection legislation and Equals Money Privacy Policy.

Is Equals Money Regulated? | Equals Money Review

Equals Money is regulated and monitored by the Financial Conduct Authority (FCA).

International Payments on Equals Money | Equals Money Review

You can enjoy market-leading rates for wide-ranging payment solutions (forward contracts, limit order, spot trades) with an experienced account manager on standby to help protect your business from volatile currency markets.

How to contact the international payments team

Email dealingdesk@equalsmoney.com or call 020 7778 7500 to speak to one of their dealers.

They are open every weekday, 8:30 am to 5:30 pm.

How Long do Payments Take?

Equals Money starts processing payments as soon as they receive your money.

Typically funds are received the same day or next day depending on the currency.

Why Choose Equals Money?

From big corporations to private individuals, Equals Money has helped more than a million customers secure the best deal when sending money overseas.

Equals Money also offers competitive rates and boasts of unparalleled customer service.

How Much it Costs to Send an International Payment

Registering for Equals Money is free and unlike most of their competitors, they don’t charge transfer fees or commission.

They are able to pass on some savings on foreign currency to you because they buy currency in bulk.

What Currencies Are Offered For International Payments?

Equals Money can make payments in 140+ different currencies. This includes all the major ones such as British Pounds, Canadian Dollars, Euros, Chinese Yuan and Japanese Yen.

Can You Send Payments Online Too?

Existing customers will be soon invited to Equals Money new online payments platform that will enable them to make international payments online 24/7.

Speak to your account manager directly or get in touch for more info about sending payments online.

What is Currency Hedging and What Hedging Tools do Equals Money Offer?

Currency hedging is meant to provide some certainty when the market is unstable.

It refers to a mechanism aimed at helping import and export businesses manage border-crossing currency exchange risk by locking in rates now for a future date.

Some of Equals Money most widely utilised currency hedging solutions include participating forwards, vanilla options and bespoke solutions.

If you need more assistance, consult your Equals account manager.

User Guide for Online International Payments

If you’re confused about how to get started with Equals Money online platform, look at this user guide. Their team is always on hand to answer your queries.

Get in touch if you don’t have access to the online system but would like to use it.

Expense Management (Spend) | Equals Money Review

To stay on top of budgets, this service lets you take back control of what’s being spent and who’s spending it.

You can order prepaid cards for your team to use in 190+ countries. Teams can only spend what you load on their cards.

To help keep your money secure, you can pause/resume cards in an instant and block ATM withdrawals.

How to Open an Equals Spend Account

To get started, you can share your details by registering through Equals Money’s website. A representative will call you to guide you on the process.

Alternatively, you can call their responsive team on 0207 778 9302 during weekdays from 9 am to 5.30 pm or email them at business@equalsmoney.com.

How to Increase Your Main Account Balance?

You must be a company controller on your account to load your main account.

To increase your balance:

- Head over to the top of your dashboard screen and click the mango “increase” button

- Follow the on-screen prompts, then when you’re ready, click next

- Choose the balance you’d like to increase

- Choose the amount you’d like to top-up

- You can indicate the purpose of your order (but it’s not mandatory)

- Confirm your order details, then click ‘Confirm’

After completing the above steps, you’ll receive Equals Money bank details and a unique reference number. To transfer money, use these details.

Equals Money team process payments every hour from 9 am – 5:30 pm (weekdays only).

How to Top Up Your Cards?

Here’s what to do to top up a card on Equals Money’s platform:

- Select “Cards” and click on “Top-up card”

- Pick the card number you wish to top-up

- Select the currency or account balance you want to use to top up

- Enter a purpose of order and a cost centre if applicable

- Click “Next” to review the order details and “Confirm” to process your order

The order will complete straightaway if there are sufficient funds in your main account balance. You will need to arrange a bank transfer in case of insufficient funds.

It’s worth mentioning that if you need to arrange a bank transfer payment, Equals Money don’t accept checks, third party payments or cash paid over the counter in the bank.

Payment must come from a company bank account under your name.

How To Transfer Funds Between Two Cards If You’ve Topped Up The Wrong Card

You must be a company controller on your account to make card-to-card transfers.

Here’s how to do it:

- Head over to the navigation panel and select “Cards” then “Card to card transfer”

- Pick the user and the card you want to transfer from

- Choose the user and card you want to transfer to

- Enter the amount you wish to transfer

- Enter the purpose of order and a cost centre if applicable

- Click “Next” to review the order details, then “Confirm” to complete your order

Remember, you can only transfer cards in the same currency.

Is it Possible to Have a FairFX And Equals Spend Account?

Yes!

Equals Spend is meant to simplify your life with impeccable expense management, whereas the FairFX Currency Card is the currency card for all your personal needs – online shopping and vacations.

How Much Can You Load a User’s Card With?

Each card can hold a balance of £150,000 at any given time.

Equals money allows a maximum card top-up in increments of £10,000 per card at any time.

What’s the Difference Between a Company Controller And a Controller?

A company controller enjoys full access to your company’s account. They are able to see everyone’s cards (including their transactions and balances), control available funds on the main account balance, and approve/reject top-up requests.

On the other hand, a controller can only see the details of the individuals the company controller assigns them. This is commonly someone that manages a team (such as a head of a department).

How to Deactivate a User If It No Longer Works for Equals Money?

You must be a company controller to deactivate a user.

This is how you do it:

- Select “Users” then click “Manage users”

- To be taken to the “User Detail” page, click on the user’s name

- In the top right-hand corner of the page, click “Edit”

- Change the user’s “role” to “disabled”

- At the bottom of the page, click “Save”

If you follow the above steps, the user’s account will be suspended immediately and they’ll no longer have access to their account.

What To Do When Your Card Has Been Lost Or Stolen

The first step is to pause the card on the app till you’re sure your card is lost. Pausing the card means it can’t be used for transactions, and if it turns up, you can continue using it.

If you’re a cardholder, controller or company controller, you can report the card stolen or lost on the Equals Spend app by contacting them or on the online platform.

The card will be automatically cancelled and you’ll be issued with a replacement. Funds on the old card will be automatically transferred over to the new card.

How to View And Annotate Your Transactions?

To view your transactions, sign in through the online platform or the Equals Spend app and:

- Click “Report” then “Transactions”

- You will be able to view finalised transactions for that month by default

- Change the filters at the top of the screen to view older transactions

To annotate/add a receipt to a transaction:

- Click “Debit amount”

- Scroll to the bottom of the page and click “Upload”

- Choose the file you wish to upload and click “Save”

Doing this will add your receipt to the transaction.

Get in touch with a company controller if you’ve added the wrong receipt to a transaction. He/she will edit this for you.

While card balances update every time you sign in, the transaction list updates overnight. This means that any payment you make today will appear on your card balance but won’t reflect on your statement until the next working day.

What to Do When You Upload The Wrong Receipt to a Transaction

To amend receipts uploaded to a transaction, you must be a company controller.

Here’s what to do:

- Go to “Reports” and click on “Transactions”

- Find the transaction you need to change

- Click on the debit amount

- Scroll to the bottom of the page, then click “Manage”

- Take out the incorrectly uploaded receipt and replace it with the correct one

How to Renew a Card When It’s About to Expire

To renew a card, you must be a company controller. It would help if you also did a renewal 2 months before the card expires.

Here’s how to do it:

- Click “Cards” the select “Pending Renewal”

- Select the month that the card is due to expire

- Use the tick boxes on the right-hand side to select the card you wish to renew

- Click “Renew selected card” then “Confirm”

You will see a green tick next to the card that has been successfully renewed.

You will receive your new Equals Spend card within 3-5 business days.

How to Unblock a Card Blocked Due to Too Many Incorrect PIN Attempts

Contact the Equals Spend team if you have blocked your card due to many incorrect PIN attempts.

To avoid your card getting automatically re-blocked, ensure you make a chip and PIN transaction within 2 days of having your card unblocked.

How Long It Takes For A Card To Arrive

Expect your new Equals Spend card within 3-5 working days.

ATM Withdrawal Limits

The ATM withdrawal limit is £2,000 (or its equivalent in foreign currency) every 24 hours, and the charge is £1.50 for each transaction.

However, different ATM providers have different withdrawal limits and can charge additional withdrawal fees.

This charge is unfortunately out of Equals Money’s control, but the ATM should give you a warning before you make the transaction.

How to Refund Money in Your Equals Spend Account to Your Company Bank Account

Send Equals Money an email if you’d like funds to be returned to your company bank account.

You should provide a reason for the refund and your bank details (account number and sort code).

To help them validate your request, remember to use the email address registered to your Equals account.

While they can refund funds in your account balance for free, there’s a £10/€10/$10 administration charge to lift funds off a card.

If you have multiple cards (in the same currency), it’s advisable to transfer the funds to one card to reduce costs.

How to Reset Your Equals Spend Password

If you don’t remember your password, click this reset your password link to receive an email with a link to create a new password.

Follow the prompts to create a new password which should be at least 8 characters long, and contain at least 1 number and 1 uppercase character.

When You Can’t Sign in to Your Equals Spend Account…

First, confirm that you are signing it to your Equals spend account and not Equals Money personal page.

Check that you’ve written your login credentials (email and password) correctly.

Ensure that you don’t leave any spaces before or after entering your email address.

How To Get A Balance Statement For Your Equals Spend Account?

Click on “Reports” and select “Balances.”

You will see your GBP balance from the oldest date first (as a default).

To see your EUR or USD account balance, select this in the drop-down box under currency.

Change your preference at the bottom of the page to expand the number of results displayed per page.

It’s also possible to convert the data as a CSV file to Excel.

How To Change Your PIN

Almost all major bank ATMs that accept MasterCard will let you change your PIN.

To do this, click the “Pin Services” option and follow the instructions on the screen.

What To Do When Your Welcome Email Link Expires

Your company controller can resend a welcome email link if yours expires.

They can do this by:

- Clicking “Users” and choosing “Manage Users”

- Clicking on the relevant person’s name then “Re-Invite User”

The new welcome email link will be valid for 2 weeks.

How to Add A New User to Your Equals Spend Account

You must be either a company controller or a controller on your account to add a new user to your Equals Spend account.

Here’s how to do it:

- Select “Users” and click “Add a new user”

- Enter the new user’s details, including their DOB and a unique email address

- At the bottom, select “Add user”

- Keep the “role” as “user” if they don’t require administration rights

Adding a user does not automatically order them a card. To get a card, the user should select “Cards” on the online platform, click “Order a new card,” and follow the prompts.

While the card is free, you must deposit at least £10, €13, or €15 at the time of order and wait for 3-5 working days for the new card to arrive.

How to Get a PIN reminder

You can get a PIN reminder on the online platform or Equals Spend app if your card number starts with 5339.

On the Equals Spend online platform:

- Select “Cards” then “Card List”

- Pick the card number you need a PIN reminder for

- At the bottom of the page, click “Reveal PIN”

- Enter the required details and click confirm

On the Equals Spend app:

- Open the app and select “Cards”

- Pick the Card you need the PIN for

- Click “Show PIN”

- Fill in security details to see your PIN

Call 01244 77 99 00 (or +44 1244 77 99 00 from overseas) to get a PIN reminder if your card number starts with 5116.

All calls are charged at standard network rates.

To receive a PIN reminder, you must have activated your card. If your card is blocked due to multiple incorrect PIN attempts, you first have to unblock your card.

How to Activate Your Equals Spend Card (Cards Starting With 5339)

The only way you can activate your card starting with 5339 is after registering for an Equals Spend account using the link in your welcome email.

Ask your company controller to re-invite you if you haven’t created an account and your link has expired.

To activate your Equals Spend card on the online platform:

- Sign in to your account and head over to your account dashboard

- In the “Pending action” box, click the blue “Activate” button

- Next to the card status page, click the big orange “Activate” button

- Enter your 16-digit card number

- Enter your DOB

- Click on “Activate card and reveal PIN Number”

To activate your card on the Equals Spend app:

- Select “Corporate Cards” and the relevant card number

- Click “Activate Card”

- Enter your 16 digit card number

- Alternatively, you can snap a photo with your phone to automatically fill it in

- Enter your DOB and press “Confirm”

Your new card will be activated and your PIN will be displayed if all your details were correct.

Your very first transaction after activating your card must be a chip and PIN transaction.

Don’t Have Your Equals Spend Sign In Details?

Locate your invitation to the platform from your email inbox. The email is sent from noreply@equals.co, so if you don’t think you’ve received it, check your junk mail.

To access the platform on the website and their mobile app, click the link in the email and set a password before you sign in.

How to Cancel a Card

You can permanently cancel a card by changing its status to “Customer Closed” if you’re a company controller, controller or cardholder.

It doesn’t matter whether the card has been activated or not; you can cancel a card by:

- Signing into your Equals Spend account via the website

- Select “Cards” on the left-hand navigation

- Click on “Card list” and pick the relevant card number

- Type the user’s name in the search box and click “Filter” if you can’t see the card

- Towards the bottom of the page, tap on the drop-down arrow under “Status”

- Select “Customer Closed” and confirm by clicking “Change Status”

If You Need Help Using The System

Check out this Mobile app user guide for Equals Spend and the Website platform user guide for Equals Spend if you need help using the system.

Two-Factor Authentication

2-Factor authentication provides a secure way to sign in to your Equals account.

Here’s how it works:

- You will receive a one-time passcode to your mobile device when you sign in to your Equals account

- You’ll be asked to enter that code before you can be signed in

- If you choose for Equals Spend to remember your device, you’ll only be asked for a code on your first sign in

Call the Equals Spend team on +44 (0) 20 7778 9302 if you’d like to check or update your mobile number.

Internet Explorer and Equals Spend

Effective August, Equals Spend won’t be supporting the use of Internet Explorer.

All customers that still use Internet Explorer are urged to use alternative browsers such as Firefox, Google Chrome, Safari and Microsoft Edge.

This step was undertaken to ensure your security.

Since Internet Explorer is no longer receiving security updates, Microsoft (the parent company) will not fix any security flaw in the browser. This makes it risky to use Windows Explorer to access your account.

Dormancy Fee for Equals Spend

If you set up your Equals Spend account after 29th January 2021, a dormancy fee will be brought into effect immediately, although it will not be possible for the fee to apply for at least 2 years.

Failure to use any of the cards on your Equals Spend account for any merchant transaction for 24 months will result in your account balance being charged. You’ll be charged up to $50 from your dollar balance, £50 from your Sterling balance and €50 from your Euro balance every month.

Don’t worry; your account will not go negative. You’ll only be charged for the currency balances you have in your account. Not holding any funds in a particular balance means zero charges to that balance.

What is Confirmation of Payee and How Does It Affect You?

Confirmation of Payee (CoP) aims at keeping your money safe and secure. It refers to a messaging service meant to help prevent fraud and payments being sent to the wrong account.

CoP covers all payments made to and from GBP accounts in the UK with an account number and a sort code.

CoP primarily focuses on CHAPS, BACS, Faster Payments and standing orders.

Payment Platforms | Equals Money Review

It’s now possible to make faster domestic payments with bank-level security and compliance.

Thanks to the UK Faster Payment Scheme, you can send immediate and forward dated payments securely to (or for) your clients.

How Long It Takes Get Set Up on a Payment Platform

It’s easy to get set up with a payment platform.

You’ll be assigned a dedicated, expert account manager. The manager will reach out and take the time to understand your needs and requirements before creating a bespoke implementation plan for your business.

How Long It Takes for The Beneficiary to Receive Their Money on a Payment Platform

2 hours is the maximum time it can take for the funds to reach the beneficiary account, although in most cases, the payment is received instantly.

Will The Beneficiaries Bank Accept Faster Payments?

According to the Faster Payments Scheme themselves, 99.99% of accounts in the UK can accept UK Faster Payments.

You can check the specific sort-code here if you’re unsure about your account or your beneficiary’s.

Broker Platform | Equals Money Review

The broker platform allows you to provide your clients with a secure self-service portal under your own brand for them to manage and use to make trades.

Account Set-Up Fees For The Broker Platform

It’s absolutely free to set up an account. Also, there are no monthly costs or hidden fees.

Can I OnBoard Both Personal And Business Clients?

The Equals Money broker platform can be set up for both personal and business clients. This flexibility allows you to maximise all revenue opportunities.

Why Partner With Equals Money?

In the past decade, Equals Money have processed upwards of £10 billion worth of payments and helped over 1 million customers to get more for their money.

Their dedicated team offers the experience of working with different businesses, and their advanced technology gives you total control to run and grow your FX business.

What Are The Costs Involved?

Equals Money offer competitive, tailored revenue share arrangements with no additional costs or hidden charges.

Online International Payments (for previous City Forex customers) | Equals Money Review

Who are Equals Money?

In 2018, City Forex became part of the Equals Group. The two brands combined to deliver a better customer experience for managing international payments.

You’ll enjoy access to their upgraded payments experience and to make use of their personalised service, you can still speak to the same account manager as before.

Why Am I Being Moved to Equals Money?

Equals Money is always innovative with its technology choices and ensures that customer experience is the best possible.

All international payments clients will be served under one brand and have full access to Equals Money new international payments platform. This move is meant to meet the evolving needs of customers

When Will I be Upgraded?

All existing online clients were upgraded by the end of November. Equals Money rolled out this product to all of their paying customers by the first quarter of 2021.

What Will Change For Me?

To make payments and book trades, you will need to sign in to Equals Money’s new online platform.

When it’s time to activate your new account, you will receive an invite link.

Use your email address as your username and create a new password.

You will also need to update how you make payments as Equals Money are also providing you with your own unique payment details.

Click here to learn more about the new features!

What Are The Benefits?

Thanks to the improved online payment experience, you can now:

- Enjoy a fresh new look and feel that is easier to use

- Add your own beneficiaries without having to call

- For domestic GBP, pay directly into your own unique set of payment details

- Make seamless trades with quicker clearing times thanks to the faster payments network

- Speak to a customer care representative directly via live chat

Why Am I Being Given New Account Details?

The new unique account details are meant to make it easy to pay directly to your own account.

If you have payment details saved in your bank from previous transfers with Equals Money, delete the old details and add the new ones.

Doing this will make it easier for you to transact with Equals Money.

Is My Money Secure?

Your funds will continue to be held by FairFX PLC under similar safeguarding arrangements.

All Equals Money funds are held in Tier 1 banks in the UK.

When using your new account details, your payments will be processed by Spectrum Payment Services (Equals Money sister company) before being transferred to FairFX PLC bank accounts for protection.

How Do I Give Feedback?

You can share your thoughts with your account manager who would be happy to feed them back to the relevant team.

How to Find Your New Account Number And Sort Code?

Go to the “Balances” section once you’re in your new account. Here, you’ll see your unique details listed there or on the confirmation page when you complete a transfer.

My Sort Code is Linked To Spectrum Payment Services; Who Are They?

Spectrum Payment Services (SPS) is a sister company to FairFX PLC and a subsidiary of the Equals Group.

With direct settlement accounts with the Bank of England, SPS is also a direct participant of the UK Faster Payment scheme.

What does Will happen to My Money?

If you have any money already held on account with Equals Money, the funds will be automatically available in your new account. You’ll be able to see view your new balance as soon as you sign in.

Will I Have All My Beneficiaries on the New Platform?

Absolutely!

All your existing beneficiaries will be available to use upon signing in.

If you want to add new beneficiaries, you can do it any time via Equals Money Online Platform and verify via a code you’ll receive on your phone.

Will I Still Be Able to Contact My Normal Account Manager?

Totally!

Your normal account manager will still be happy to talk to you one-on-one and be temporarily available on live chat.

Equals Money are committed to delivering a personal service to their clients, and the upgrade of their online platform flawlessly complements the service customers are used to receiving from them.

Are There Any Fees for Having This Account?

Having an account on the online international payments platform is completely free.

Can I Still Order Cash?

Yes!

You can order cash for your holidays with FairFX, the Equals Group sister brand.

Get in touch with your account manager if you need cash for a business trip.

How Do I Know This Isn’t A Scam?

Engage with your normal account manager. He/she will be able to talk to you about this process.

Will I See Past Trades On The New Platform?

Absolutely!

You will be able to see existing trades when you sign in.

Contact your account manager if you need information on trades that are older than 3 years.

What Is A Forward Contract?

How forward contracts work is that they fix the exchange rate over a set period on a pre-established volume of currency.

It would be best if you made a deposit on booking. You can pay the remainder as and when you require to make onward payments.

Depending on your individual needs, different forward strategies can be executed.

Contact your assigned dealer if you are new to forward contracts or have any questions

Equals Money Customer Support | Equals Money Review

Customer reviews across multiple websites indicate that Equals Money is a trustworthy provider of international currency transfers.

Equals Money’s talented and supportive customer service team is always on hand to provide round-the-clock real, human support.

Who are the Equals Money’s Competitors? | Equals Money Review

Alternatives to Equals Money include Currency Fair, World First and OFX.

Equals Money Review Verdict: Should I Use Equals Money? | Equals Money Review

Equals Money has been in business since 2007 and was voted as the UK’s most recommended brand for payment services 2020.

The company’s customer-centric model delivers money management solutions at transparent and competitive costs. They have a comprehensive privacy policy and complete terms and conditions.

They are also regulated by the FCA and use a secure online platform for money transfers.

All these are compelling reasons why you should use Equals Money.

Recent Comments