Which app turned my coffee change into real money? The results surprised me.

Imagine this: Every time you buy coffee, a magical financial elf squirrels away your spare change. Six months later, you open a digital treasure chest to find $287.43 you didn’t know you had. No effort. No pain. Just free money growing while you live your life.

That’s the round-up investing dream. I tested it with real money across three popular apps. Here’s what actually happened.

Table of Contents

My Awkward Money Confession

As a personal finance coach, I should be great with money, right? But here’s my secret: I’ve always struggled with investing. The process felt like:

Decision Paralysis

Which stocks? What funds? How much? My brain would freeze at the options.

Emotional Barriers

Transferring $100 felt like losing money, not building wealth.

Time Constraints

Between work and family, researching investments felt impossible.

Round-up apps promised to solve this. Would they work? I decided to test them with my own money for six months.

How the Experiment Worked

On January 1st, I connected all three apps to my checking account with identical settings:

- Round-ups: Every purchase rounded up to nearest dollar

- Portfolio: Moderately aggressive (70% stocks/30% bonds)

- Extra savings: $5/week added automatically

- Duration: 6 months (January 1 – June 30)

I continued living normally, tracking everything. The apps worked silently in the background, collecting my digital pocket change.

The Contenders: A Close Look

Acorns

The Round-Up Pioneer

What I Loved:

- Beautiful, simple interface

- “Found Money” partnerships (extra cashback)

- Educational content for beginners

What Frustrated Me:

- $3/month fee felt steep for small balances

- Limited investment options

- Round-up delays of 2-3 days

Personal Moment: When I saw my first $10 investment grow to $10.37, I actually did a little dance. That’s when I realized – this wasn’t just spare change, it was real investing.

Chase Autoinvest

The Banking Giant’s Entry

What I Loved:

- No additional fees for Chase customers

- Instant round-ups (no delay)

- Seamless integration with banking

What Frustrated Me:

- Clunky mobile experience

- Less educational content

- Only 5 portfolio options

Personal Moment: When my coffee round-up bought fractional shares of Disney, it felt surreal. I was literally becoming a Disney shareholder with pocket change.

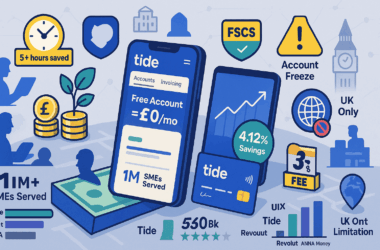

Revolut

The European Challenger

What I Loved:

- Fractional shares in individual stocks

- Low $1/month metal plan fee

- Crypto round-up option

What Frustrated Me:

- Complex fee structure

- Occasional app glitches

- Less robust customer support

Personal Moment: When I realized I owned pieces of Tesla, Apple, and Amazon through spare change, I felt like a Wall Street mogul during my morning commute.

The Moment of Truth: 6-Month Results

On June 30th, I nervously opened all three apps. Here’s what I found:

| Platform | Total Invested | Current Value | Growth | Fees Paid | Net Gain |

|---|---|---|---|---|---|

| Acorns | $243.67 | $250.19 | +2.68% | $18.00 | -$11.48 😞 |

| Chase | $238.92 | $245.85 | +2.90% | $0.00 | +$6.93 🎉 |

| Revolut | $241.50 | $250.75 | +3.83% | $6.00 | +$3.25 👍 |

The Emotional Win

Beyond the numbers, something profound happened: I stopped fearing investing. Watching my spare change turn into real investments demystified the whole process. The psychological barrier crumbled with each $0.32 round-up.

I started with “just coffee money” and ended up with a real portfolio. More importantly, I gained the confidence to invest intentionally.

The Surprising Winner

Chase Autoinvest delivered the best net returns thanks to its fee-free structure for existing customers.

But here’s the real victory: All three apps turned me into an investor.

That $6.93 gain from Chase? It’s not life-changing money. But the mindset shift? Priceless.

Who Should Choose Which App?

Based on my experience, here’s who each platform is perfect for:

Choose Acorns If:

- You’re brand new to investing

- You value educational content

- You don’t mind fees for a polished experience

- You shop at their partner brands often

Choose Chase If:

- You’re already a Chase customer

- You want the simplest, fee-free experience

- You prefer integration with your banking

- Instant round-ups matter to you

Choose Revolut If:

- You want to invest in individual stocks

- You’re interested in crypto options

- You’re comfortable with a slightly complex app

- You travel internationally frequently

Ready to Turn Your Spare Change Into Real Money?

Start your investment journey today with zero pressure

“The best time to start was yesterday. The second best is today.”

Recent Comments