The rise of Artificial Intelligence in the financial sector has been nothing short of revolutionary, particularly in the realm of AI-based credit scoring. Traditional methods of assessing creditworthiness, which heavily relied on manual processes and basic analytics, are being rapidly replaced by AI-based credit scoring systems. These sophisticated systems herald a new era of efficiency, accuracy, and inclusivity.

So, what exactly is AI-based credit scoring, and how does it work?

Table of Contents

AI Credit Scoring

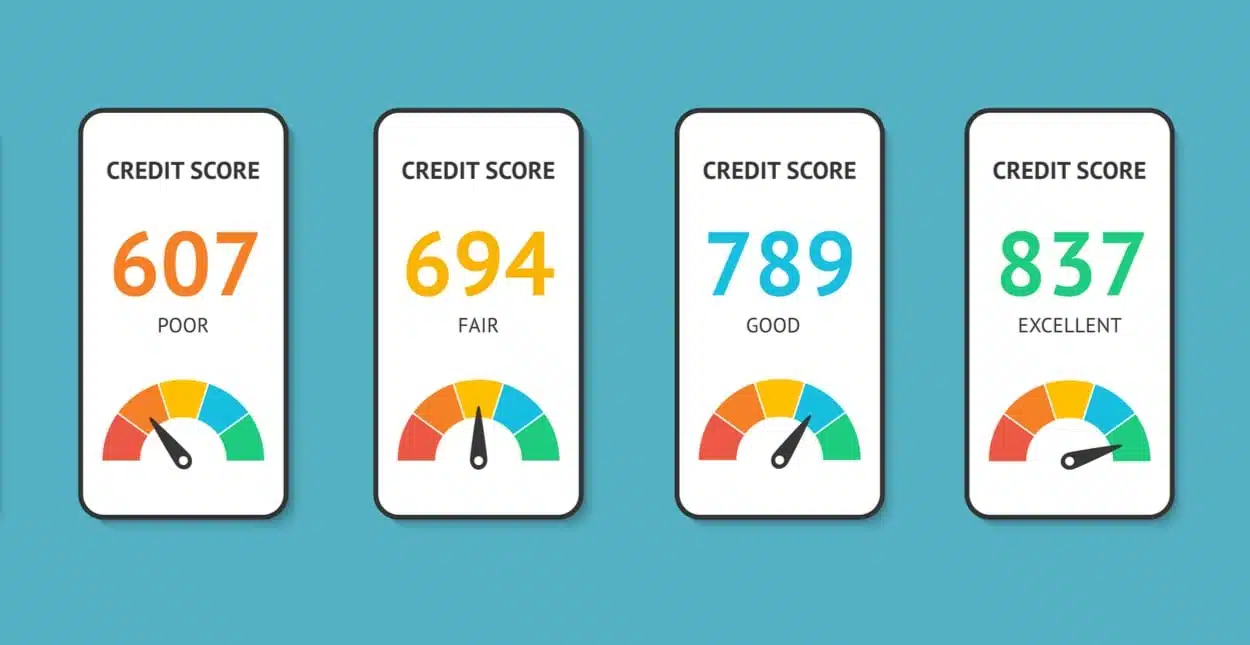

Traditional credit scoring evaluates an individual’s or business’s creditworthiness based on a limited set of data, mainly focusing on past credit behavior. This method, while effective, can overlook intricate patterns and fail to consider alternative data sources, potentially resulting in an incomplete assessment.

In contrast, AI-based credit scoring broadens the horizon. It leverages machine learning algorithms to digest and learn from a vast array of data that goes beyond traditional credit information. The AI system can analyze both structured and unstructured data, interpreting complex patterns that might go unnoticed by conventional credit scoring models.

By using AI, the credit scoring process becomes more comprehensive and precise, ensuring a more accurate prediction of creditworthiness. It takes into account a wider range of factors, providing a holistic view of an individual’s or business’s financial health. This refined approach to credit scoring is what sets AI-based models apart from their traditional counterparts.

Benefits of AI Credit Scoring

As always with anything, there is an ongoing debate about the benefits and drawbacks of AI credit scoring, however the benefits in this case outweigh the drawbacks significantly.

Firstly with everything AI, there is going to be an increase in the efficiency of the credit scoring process. AI will end up saving much-needed resources, which can be diverted toward other core operations.

Next, the predictive power of AI can help lenders make more informed decisions, reducing the risk of default. As recent news articles suggest, AI-based credit scoring is seen as a promising and relevant solution for assessing a customer’s ability and willingness to pay off their debts.

Enhancing Predictive Power and Financial Inclusivity

In addition to this, AI-based credit scoring promotes financial inclusivity. By considering alternative data, AI-based credit scoring can provide credit scores for the ‘unscorable’ or underbanked population, thus promoting financial inclusion. This can unlock a lot of liquidity across the world, creating nothing short of a financial revolution.

Tackling Bias and Embracing Fairness

Furthermore, AI can help reduce bias in credit scoring by using objective criteria to assess creditworthiness, which can help minimize the impact of factors such as race, gender, or socioeconomic status that can unfairly influence credit decisions. Companies like H2O AI Cloud are developing solutions that enable banks to run credit-scoring AI models to better predict the credit potential of individuals with little to no credit history data.

AI’s Transformative Potential

AI’s ability to bypass the traditional credit reporting and scoring system that can perpetuate existing biases makes it a potentially transformative tool in financial services. AI-based credit scoring leverages massive amounts of data held by financial institutions and accurately analyzes data items to predict creditworthiness.

In addition, no-code AI credit scoring software is emerging, which uses AI and machine learning algorithms to build unique scoring models within seconds to assess default risk accurately.

Challenges and Regulatory Considerations

However, alongside these advantages come certain challenges. The black-box nature of some AI models can lead to a lack of transparency and interpretability. There are also concerns relating to data privacy and security. Additionally, ensuring fairness and avoiding algorithmic bias is a significant challenge.

Despite these challenges, the future of AI-based credit scoring looks promising. With ongoing advancements in AI and machine learning, these systems are becoming increasingly sophisticated, capable, and reliable. As they continue to learn and improve, their predictions will become even more accurate and their applications more widespread.

Moreover, regulatory bodies worldwide are beginning to acknowledge the potential of AI in finance, developing frameworks and guidelines to ensure its responsible use. This regulatory support, coupled with technological advancements, is set to propel the growth of AI-based credit scoring.

However, the rise of AI in credit scoring also brings about regulatory challenges. Credit scores can control housing decisions, the cost of taking out a loan, and even employment opportunities. As such, there’s a growing need for new approaches to regulate AI in credit scoring to ensure fairness and transparency.

Conclusion

AI-based credit scoring is a transformative technology that holds immense potential for the finance industry. While there are challenges to overcome, the benefits it offers are undeniable. As we move forward, it will be fascinating to see how this technology evolves and continues to redefine the landscape of credit scoring..

Recent Comments